Decorating with Investment Art: Cultivating Aesthetic Joy & Enduring Value

I’ll admit, it’s a peculiar dance, isn't it? The one we do between our heart, which swoons over a splash of color or a compelling form, and our ever-so-sensible brain, which immediately starts calculating, "But is it worth it?" I remember standing in front of a mesmerising abstract painting once – all vibrant blues and fiery reds – completely lost in its energy. My heart was pounding, whispering, "You need this." Then, as if on cue, my brain clicked into gear: "Yes, but is it a smart acquisition? What's its future?" For years, I approached art purely from an aesthetic perspective – a piece either spoke to me, or it didn’t. End of story. But as I’ve delved deeper into the art world, both as an artist and a collector, I’ve learned there’s a fascinating, sometimes challenging, sweet spot where beauty and financial prudence meet. It’s a tightrope walk, really, and sometimes my heart wants to jump right off into a sea of vibrant hues, while my brain tugs me back to solid ground. This article is my attempt to map that terrain, guiding you to make informed decisions that balance aesthetic enjoyment with potential financial value – because, why settle for one delight when you can have two?

This isn’t about turning your home into a sterile gallery vault, mind you. It's about enriching your living space with pieces that not only resonate with your soul but also hold the potential to be a wise, long-term asset, a tangible piece of cultural capital to pass down through generations. Think of it as decorating with a quiet, confident wink. You’re not just buying a painting; you're investing in a piece of history, an artist’s journey, and, perhaps, your own legacy. For me, it’s about that double delight: the daily joy of living with art you adore, coupled with the quiet satisfaction that it’s also a thoughtful asset.

Beyond the Canvas: The Unique Appeal of Art as Investment

We all want our homes to feel like us. A sanctuary, a reflection, a place where every object tells a story. For me, that story often involves vibrant abstract art that fills a room with energy. But what if those pieces could also tell a story of smart decision-making, a subtle nod to foresight and cultural capital? The idea of decorating with investment art might sound a bit intimidating, like something only suited for high-stakes auctions and hushed gallery whispers. But I promise you, it's far more accessible than it seems.

It's about finding that delightful overlap where your personal aesthetic joy aligns with a piece's potential for appreciation. It’s like discovering a vintage designer dress that fits you perfectly and is going to be a collector’s item – why settle for one benefit when you can have two? Art offers a multi-faceted return: it enhances your daily life, enriches your environment, and offers a unique form of cultural capital. This "cultural capital" isn't just about owning something old or expensive; it's about art as a signifier of intellectual engagement, a conversation starter, a reflection of personal values, and a contribution to the broader cultural discourse. It can even contribute to a personal legacy, signalling a refined sensibility and a commitment to beauty that can be passed down through generations. Plus, there's the satisfaction of supporting an artist's vision and becoming part of their journey. My own journey of collecting emerging abstract art: a guide to discovering tomorrow's masters has always been deeply personal, but I also recognize its potential as a tangible asset. With that in mind, let's explore what truly separates a beautiful object from a potential investment.

Art as a Tangible Asset: More Than Just Aesthetics

Unlike many digital or purely financial assets, art is something you can touch, see, and live with every day. It offers a unique blend of emotional and material value. Think about it: a stock certificate sits unseen, but a vibrant painting transforms a room. This tangibility brings its own set of investment benefits and considerations:

- Physical Durability and Longevity: While requiring care, well-made art is designed to last. A painting can endure for centuries, potentially outliving many other forms of investment. This durability contributes to its ability to be passed down as a legacy. Of course, this durability is contingent on proper understanding art insurance: protecting your valuable collection and care.

- Portability: While large pieces can be challenging, art is generally a movable asset. It can travel with you, adapting to different homes or even being loaned to exhibitions, further enhancing its provenance and value.

- Emotional Security: In times of economic uncertainty, having a tangible asset that you can physically possess and enjoy can offer a sense of stability and emotional comfort that purely financial investments might not.

- Potential Hedge Against Inflation: Historically, certain segments of the art market have demonstrated a degree of resilience against inflation and economic downturns, sometimes acting as a safe haven or an alternative investment during volatile periods. It's not a guarantee, but a factor many savvy collectors consider.

Decoding Value: What Makes Art an "Investment"?

So, how do we move from "I love this!" to "This could be a smart move?" Let's break down what makes art more than just a pretty picture. Before we start envisioning masterpieces gracing your walls, let’s quickly demystify what makes art an "investment." It’s not just about what you like; it’s about a combination of factors that savvy collectors – and my sensible brain, usually busy calculating potential returns – look for. While passion is crucial, a little market understanding goes a long way. This is the part where I try to quiet my heart's impulse buying tendencies and let logic take the lead.

Here are a few key elements that separate a beautiful object from a potential investment:

- Condition and Rarity: The physical condition of an artwork is paramount; damage or poor restoration can significantly diminish value. I once saw a stunning 19th-century landscape almost pass me by because of some amateur restoration efforts that had dulled its original vibrancy. Luckily, a conservator brought it back to life, but the initial damage meant a much lower entry price. Likewise, rarity matters. Is it a unique work (a painting, a one-off sculpture) or part of a limited edition (prints, photographs, multiples)? Generally, unique works hold the highest investment potential, though limited editions from established artists with small edition sizes can also be very valuable. The condition also affects its conservation and long-term stability. A pristine, original canvas from a renowned artist will almost always command more value than a damaged piece, even if it's been expertly restored. Consider a rare 19th-century oil painting – if it's been kept in optimal conditions, its colors vibrant and canvas intact, its value will be significantly higher than an identical piece with extensive cracking or amateur repairs.

- Provenance: This is the documented history of ownership. Think of it as the artwork's resume. A clear, well-documented provenance, including past owners, exhibitions, and sales records (e.g., original invoices, gallery labels, catalogue raisonné entries), adds significant value and authenticity. A catalogue raisonné is a comprehensive, annotated catalog of all the known works by an artist, an essential tool for verifying authenticity and tracking market value. For example, a piece owned by a renowned collector or exhibited in a major museum will often command a higher value than a similar piece with an unknown history. Imagine a painting whose history can be traced back to a famous European royal collection – that documented journey through esteemed hands instantly elevates its desirability and price.

- Artist's Pedigree and Trajectory: Is the artist established with a proven track record, or an emerging talent with significant buzz? For an emerging artist, "buzz" can manifest as being featured in reputable art fairs (e.g., Frieze, Art Basel), receiving prestigious grants or residencies (e.g., a Guggenheim Fellowship, a residency at MacDowell), garnering positive reviews in critical publications (e.g., Artforum, Hyperallergic), or being acquired by notable private or public collections (e.g., MoMA, Tate Modern). Peer recognition, such as inclusion in significant juried group exhibitions or mentorship by established artists, is also a strong indicator. Beyond surface-level buzz, I look for a consistent, evolving body of work and a clear artistic vision articulated through artist statements and interviews. A serious artist engages with their craft and the art world beyond just making pretty pictures. Understanding the evolution of abstract art: key movements and their collectible value can offer historical context.

- Market Trends and Demand: While I never advocate chasing trends blindly – remember, your home, your taste! – being aware of what’s gaining traction in the art world can inform your choices. Follow reputable art market reports (e.g., Artnet, Artprice, TEFAF Art Market Report), observe auction results from major houses like Sotheby's and Christie's, and engage with gallerists and art advisors to understand broader movements without letting them dictate your taste entirely. To distinguish fleeting fads from consistent traction, look for artists whose work has shown steady price increases over several years, who are consistently exhibiting, and whose themes or styles resonate with enduring cultural conversations. Pay attention to both primary market (direct sales from galleries or artists) and secondary market (auction sales, resales) trends; consistent upward movement in both is a powerful signal. My own approach is often about collecting emerging abstract art: a guide to discovering tomorrow's masters, which is a balance of intuition and informed speculation. The goal isn't to be a market speculator, but an informed collector.

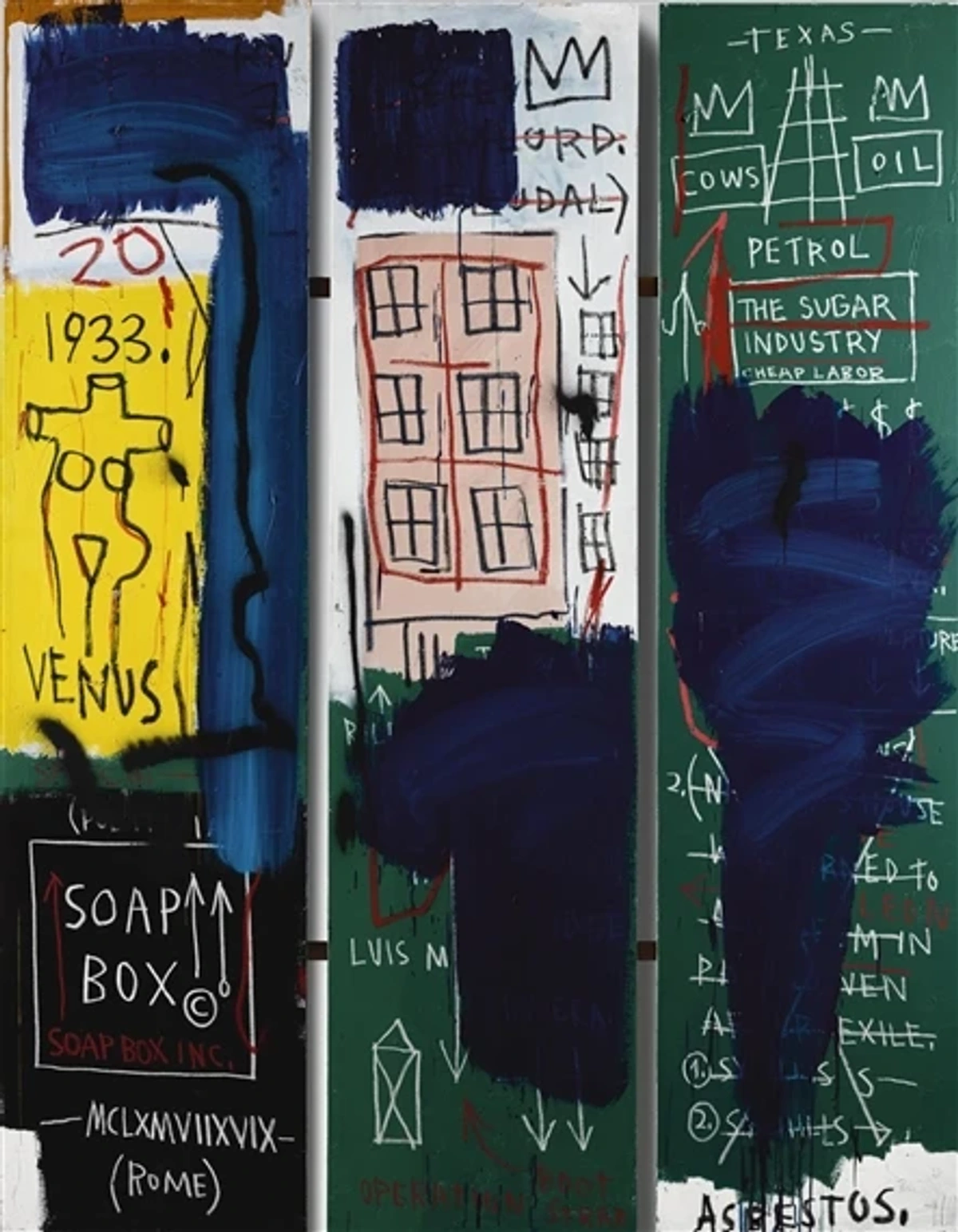

Jean-Michel Basquiat Untitled Triptych Art, https://creativecommons.org/licenses/by-sa/4.0

The Art of the Smart Buy: Navigating the Acquisition Journey

Now for the fun part: actively seeking out those elusive pieces that sing to your soul and whisper sweet nothings about future returns. It requires a bit of research, a dash of intuition, and a whole lot of looking. (Which, let's be honest, is half the joy of collecting!)

1. Do Your Homework (But Don't Forget Your Heart)

Before you commit, dig a little. Research the artist, their exhibition history, and any critical acclaim. Read art publications, visit local galleries, and attend art fairs – especially degree shows for emerging talent. Don’t be shy about asking gallerists questions; they are a wealth of information and often serve as invaluable guides. Think of it as a treasure hunt where the map is made of reviews and exhibition catalogs. Here are a few questions I always ask: "What's the artist's exhibition history?", "How do you see their career developing?", "What's the provenance of this piece?", and "What conservation advice do you have?" Always make sure to delve into the artist's statement and understand their philosophical approach; a compelling vision often underpins lasting value. While a good gallery can guide you, ultimately, you should be the one truly engaging with the art. For more complex acquisitions, or if you feel overwhelmed, consider engaging an independent art advisor; their expertise can be invaluable in navigating the market and due diligence.

2. Authentication: The Foundation of Value

Authenticity is paramount. Without it, even the most beautiful piece has no real investment value. Always ensure that the artwork is genuine. This often involves:

- Expert Opinions: Seeking verification from recognized experts in the artist’s field or a relevant art historical institution.

- Documentation: Relying on robust provenance, certificates of authenticity, and inclusion in a reputable catalogue raisonné.

- Forensic Analysis: In some high-stakes cases, scientific analysis (pigment dating, fiber analysis) might be used to confirm age and materials. Don't be shy about asking for proof, or consulting an expert if anything feels off; it's a critical step in mitigating risks.

3. Understand Value, Don't Just Assume It

Not all art is created equal, and not all beautiful art will appreciate financially. Focus on quality, originality, and the artist's unique voice. If a piece looks like a million others, it's less likely to stand out in the long run. What does a "unique voice" look like in abstract art? For me, it's often a signature brushstroke that feels instantly recognizable, an innovative use of color that defies convention, a distinct compositional approach that challenges the eye, or a profound conceptual underpinning that sets the artist apart. To evaluate a piece's originality, consider a simple checklist: Is it signed by the artist? What is the medium and how is it used innovatively? If it's a print, what is the edition size, and is it genuinely limited? Learn about the definitive guide to art criticism: how to analyze and appreciate art to sharpen your eye. An original painting will almost always hold more investment potential than an open-edition print, though limited-edition prints from established artists can also be valuable. It's a spectrum, and understanding where a piece falls is crucial.

4. Budgeting and Acquisition Strategy: Knowing Your Limits and Opportunities

Art collecting doesn't have to break the bank. You can start small, perhaps with works on paper or smaller canvases by emerging artists. Entry-level pieces often fall in the range of a few hundred to a few thousand euros, offering an accessible entry point, though prices can vary wildly based on the artist's reputation, medium, and size. Set a budget that you're comfortable with and stick to it. Consider different acquisition avenues, each with its own benefits and considerations:

Acquisition Avenue | Pros | Cons |

|---|---|---|

| Reputable Galleries | Curated selections, exclusive representation, clear provenance, excellent after-sales support, long-term relationships. | Higher initial prices, less room for negotiation, limited inventory from a single artist/style. |

| Auctions | Opportunities for good value, access to established artists, transparent market pricing (previous results). | Requires expertise/research, strong stomach for competition, higher risks (bidding wars), less direct information, buyer's premium fees. |

| Online Platforms | Vast selection, convenience, global reach, often more accessible price points. | Necessitates thorough due diligence (authenticity, condition), risk of misrepresentation, shipping challenges, less personal interaction. |

| Direct from Artist's Studio | Personal connection, often better price (no gallery commission), direct insight into process/vision, supports artist directly. | Less market validation/provenance history (for emerging artists), limited selection, less after-sales support infrastructure. |

If you're near my studio in 's-Hertogenbosch, consider visiting my den bosch museum for a taste of the art I create and admire – a personal connection makes all the difference.

Art fair booth paintings, https://creativecommons.org/licenses/by-sa/4.0

Building Relationships in the Art World

Beyond the art itself, the connections you forge are invaluable. Collecting art isn't just a transaction; it's a journey, often shared. Building relationships with artists, gallerists, and other collectors can enrich your experience and open doors to opportunities you might otherwise miss. Gallerists, for instance, are often the first to know about new works, upcoming exhibitions, or even off-market pieces. They can offer insights, advice, and even help you build a cohesive collection over time. Establishing a genuine connection means they understand your tastes and can proactively guide you. And connecting with artists directly, perhaps through studio visits, offers a deeper understanding of their process and vision. It's a wonderfully collaborative ecosystem, and being a part of it makes the entire journey so much more rewarding.

People Viewing Art at Exhibition, http://creativecommons.org/licenses/by-sa/4.0/

Curating Your Collection: Integrating Art into Your Home's Soul

This is where the decorator in me really lights up. What’s the point of owning a magnificent piece if it’s tucked away, or worse, clashes with your carefully curated space? The goal is to make it shine, to integrate it seamlessly (or strikingly, if that’s your vibe) into your home, ensuring it enhances, rather than overwhelms, its surroundings. Remember, your home is not a museum (unless you decide to turn it into one, which, frankly, sounds like a fascinating, albeit slightly obsessive, project!)

1. Prioritize Personal Joy (Always, Always)

I've seen too many people buy "important" art that they secretly despise because someone told them it was a good investment. Don't be that person. You have to live with it. I once bought a piece that, on paper, had all the right investment markers, but it just never quite felt right. It was a constant visual discord, a subtle hum of regret. I learned my lesson: if a piece doesn't spark joy, no amount of potential appreciation will make up for that daily visual discord. My philosophy on the heart of the home: my guide to choosing abstract art that resonates with your space and soul applies equally here. Choose what you love, then let its potential value be the delightful bonus. Always, always, lead with your heart.

2. Strategic Placement and Lighting: Make it Sing

Good art, especially investment art, deserves to be seen. Think about the flow of your space and where the piece can truly breathe. A large, commanding abstract might be perfect for a focal wall, while a smaller, more intricate work could anchor a cozy reading nook. And please, for the love of aesthetics, get the lighting right! Proper lighting not only enhances the artwork's visual impact but also protects it. Avoid direct sunlight, which can cause fading and material degradation. Consider specialized art lighting that provides even, UV-filtered illumination. How to choose the right lighting to enhance your abstract art collection is a whole art form in itself.

Art Gallery with Red Walls and Skylight, https://creativecommons.org/licenses/by-nc/4.0/

3. Cohesion vs. Collection: Your Home, Your Rules

When decorating your home with investment art, you don't need every piece to match. In fact, a curated collection of diverse pieces can be far more interesting and reflective of your journey. The key is to find common threads – perhaps a shared color palette (even if subtle), a similar artistic movement, a consistent exploration of a particular theme, or simply a consistent level of quality that ties them together. For ideas on how to make varied pieces harmonize, check out curating your space: how abstract art elevates modern interiors. And if you're looking for art that can make a statement, you can always buy directly from my collection.

Neutral Modern Living Room, https://creativecommons.org/public-domain/

Safeguarding Your Assets: Protecting Your Investment for the Future

Okay, now that you’ve thoughtfully acquired and artfully placed your investment pieces, it’s time to protect them. This isn't just about preserving their beauty for your enjoyment; it’s about safeguarding their long-term value. Think of it as a silent guardian for your aesthetic and financial choices.

- Insurance, Insurance, Insurance: This might sound boring, but it's absolutely essential. Get your pieces professionally appraised and ensure they're adequately covered by a specialized art insurance policy, rather than just your standard home insurance. Standard policies often have low limits for valuable items and may not cover specific art-related risks like transit damage, professional handling mishaps, or a sudden change in market value. A dedicated art policy is tailored to these unique risks and offers more comprehensive protection. Understanding art insurance: protecting your valuable collection is crucial.

- Environmental Control: Art hates extremes. Avoid direct sunlight, which can fade colors, embrittle paper, and degrade materials. Maintain a stable temperature (ideally around 70°F or 21°C) and a consistent relative humidity level (around 50% is often recommended). Fluctuations can cause materials to expand and contract, leading to cracking or warping. Beyond general conditions, be mindful of specific vulnerabilities of contemporary abstract art – some modern pigments can be particularly light-sensitive, and certain canvases or mixed media pieces require specific climate considerations. Also, protect against pests, mold, and airborne pollutants, and be mindful of off-gassing from new frames or construction materials, which can also cause damage. Beyond the room's environment, ensure your framing uses archival, acid-free mats and UV-filtering glass to provide an extra layer of protection. Proper environmental control is key to a piece’s longevity, as even subtle degradation can impact its market value over decades. For instance, a fragile watercolor might require UV-filtering glass and a stable humidity, otherwise, colors could fade and paper warp, significantly reducing its worth.

- Professional Handling and Storage: When moving, cleaning, or re-framing, always consult professionals who specialize in art. A clumsy DIY job can significantly diminish a piece's value, and sometimes, the damage is irreversible. If you notice a minor scratch or a subtle discoloration, resist the urge to 'fix' it yourself. Instead, seek the advice of a qualified conservator who understands the specific materials and historical context of the piece. Professional cleaning and restoration, when necessary and expertly done, can preserve or even enhance a piece's value, but only if handled by specialists. If you need to store pieces long-term, ensure it’s in a climate-controlled, secure facility specifically designed for artwork.

- The Long-Term View: Strategic Portfolio Management: While the primary joy of investment art is living with it, part of being a savvy collector is understanding the long-term lifecycle. There might come a time to rebalance or deaccession a piece – perhaps your taste evolves, you need liquidity, or the market for that artist reaches a peak. This decision requires careful consideration of market conditions, the artist's current trajectory, and consultation with gallerists or advisors. It’s not a quick flip, but a carefully planned strategic move, much like managing any other investment. Keeping meticulous records and knowing about the artist's catalogue raisonné can be invaluable here, as it validates authenticity and aids in tracking market value.

Gerhard Richter Cage Painting Tate Modern, https://creativecommons.org/licenses/by-nc/2.0/

Tax Implications of Art Investment

Beyond the aesthetic and market value, it’s important to remember that investment art can have significant tax implications. While I'm no tax advisor (and you should always consult a qualified professional!), generally, art is considered a collectible. This means that if you sell a piece that has appreciated in value, any capital gains may be taxed at a different, often higher, rate than other investments like stocks or bonds. Conversely, donating art to a qualified institution can offer substantial tax deductions, which might be a consideration for estate planning or philanthropic goals. For example, in many jurisdictions, capital gains on collectibles held for over a year are taxed at a long-term capital gains rate, which can still be higher than standard long-term capital gains rates for other assets. Understanding these nuances is part of being a truly informed collector and can significantly impact the net return on your art investment.

My Personal Take: Trust Your Gut (Mostly)

I’ve had my share of "what if" moments in the art world. "What if I’d bought that piece when it was still affordable?" "What if this artist takes off?" It’s tempting to get caught up in the speculation, to let the brain constantly calculate. But honestly, the most fulfilling pieces I’ve acquired, both for my own collection and for clients, have been those where the aesthetic appeal was paramount, and the investment potential was a delightful, albeit carefully considered, bonus. I remember agonizing over a purchase once, trying to intellectualize its future value. In the end, I went with my gut, and it became one of my most cherished pieces, its financial appreciation merely a happy coincidence. The heart, it seems, often knows best, even when the brain is busy calculating.

My advice? Start with what you love. Learn what truly moves you, whether it’s the bold composition in abstract art or the subtle interplay of color. Then, once your heart has made its choice, let your head step in for a sanity check. A quick glance at the artist’s trajectory, a peek at the provenance, and a thought about its long-term care. If both heart and head give a nod, you’ve found yourself a winner – a piece that will enrich your home, your soul, and perhaps, your portfolio too. My commitment as an artist is to create works that inspire precisely this dual appreciation – pieces that resonate deeply and hold enduring value. It's a journey, not a destination, and my own timeline as an artist is a testament to the continuous evolution of both art and collecting. Enjoy the process, for that is truly where the value lies. And remember, while these principles generally apply, investing in art, much like any market, carries inherent risks. Not every piece will appreciate, and market conditions can fluctuate, sometimes influenced by speculative bubbles. It’s essential to approach it with both passion and a pragmatic understanding that value is never guaranteed. This guide focuses primarily on abstract art, my area of expertise, but the core principles of informed collecting and aesthetic appreciation apply to all genres, from figurative to landscape. If you're inspired to find pieces that speak to you, exploring my own collection might offer some ideas on how heart and head can truly align.

Frequently Asked Questions (FAQ)

Can all art be considered an investment?

No, not all art is an investment. While all art has aesthetic and emotional value, "investment art" specifically refers to pieces that are likely to appreciate financially over time. Factors like the artist's reputation, provenance, rarity, condition, and market demand play a significant role. It's important to remember that all art investment carries a degree of speculation; value is never guaranteed.

How do I know if an emerging artist's work will appreciate?

Identifying emerging artists whose work will appreciate involves a degree of speculation. Look for artists who show consistent quality, are gaining recognition from reputable galleries or critics, have a unique vision, are actively exhibiting in significant venues, and are being acquired by discerning collectors. Beyond current buzz, pay attention to the artist's career trajectory – a steady progression of shows, critical engagement, and acquisitions by public institutions are strong indicators. Attending degree shows, smaller independent galleries, and art fairs can be great places to discover such talent. Understanding their artist statement and the discourse around their work is also crucial.

Should I buy art from a gallery, an auction, or online?

Each has its pros and cons. Galleries offer expertise, curated selections, clear provenance, and often better after-sales support, and they are excellent for building long-term relationships. Auctions can yield good value but require more knowledge, a strong stomach for competition, and carry higher risks. Online platforms offer convenience and wide selection, but thorough due diligence on authenticity, condition, and reliable shipping is paramount. For unique pieces directly from an artist, sometimes a personal connection and studio visit is the best route.

How often should I get my investment art appraised?

It's generally recommended to get investment art appraised every 3-5 years, or if there's a significant change in the artist's market (e.g., a major museum show, a record-breaking auction sale), a major exhibition, or a shift in the overall art market. This ensures your insurance coverage is accurate and you understand the current value of your collection. Always keep meticulous records of all purchases, sales, and appraisals.

What are common mistakes new art investors make?

New investors often fall prey to chasing trends, buying purely on speculative hype, neglecting due diligence on provenance and condition, failing to properly insure or care for their art, or buying art they don't truly love just for its perceived investment value. Always balance your passion with prudence, and remember that market bubbles can influence values, making a long-term perspective vital.

When should I consider hiring an art advisor?

An art advisor can be invaluable if you're making a significant investment, lack time for extensive research, are new to the art market, or need specialized expertise in a particular genre. They can help with due diligence, provenance verification, market analysis, negotiation, and even collection management, providing a layer of professional guidance that can mitigate risks and ensure smarter acquisitions. While they come at a cost, their expertise can save you money and headaches in the long run, and offer an objective perspective.