Art Insurance for Artists and Collectors: Safeguarding Your Passion, Investment, and Legacy

An artist's essential guide to art insurance. Protect your passion, decode jargon, get valuation tips for artists, and ensure comprehensive coverage for your collection.

Art Insurance for Artists and Collectors: Safeguarding Your Passion, Investment, and Legacy

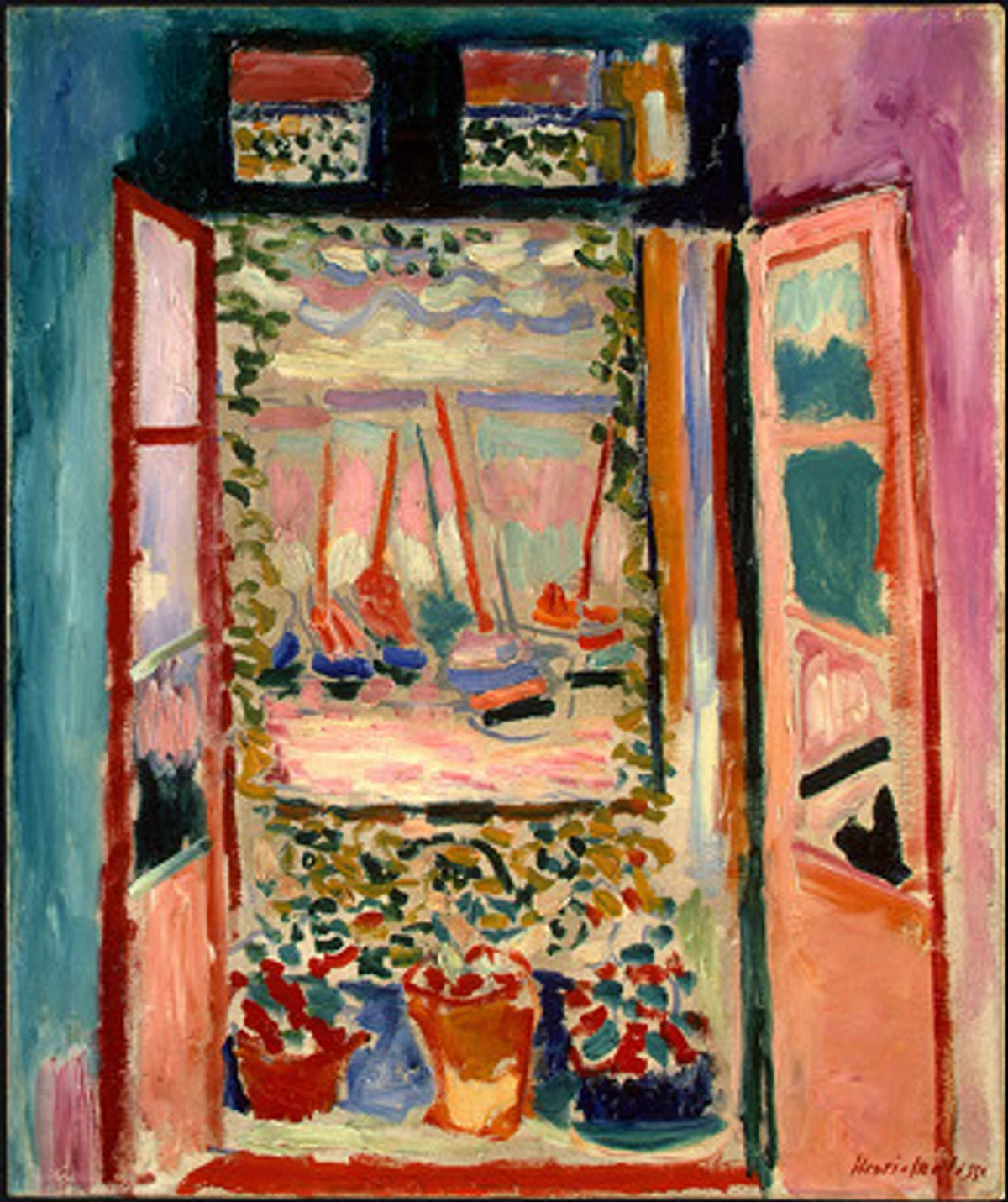

As an artist, my creations are more than just objects; they are extensions of my soul, my investment, and my story. And for collectors, each piece holds a unique narrative, a captured moment, a silent conversation. But with that deep connection comes a quiet hum of anxiety – the 'what ifs' that can threaten to overshadow the joy of making and collecting. For too long, art insurance felt like a dry, bureaucratic chore, a topic I'd rather avoid than confront. Yet, as I delved deeper, I realized it's not about tempting fate, but about empowering ourselves. It's a powerful tool for preserving not just the physical object, but the very essence of what makes art so vital. This guide will strip away the complexity, explore the real 'what ifs' that artists and owners face, decode the jargon, and lay out a clear path to secure your collection and your peace of mind.

My own journey with art insurance truly began a few months ago after a minor (thankfully!) scare with a beloved painting – a clumsy moment involving a wobbly ladder and a fleeting thought of "oh, dear gods, what if...?" It was a silly, fleeting incident, but it kicked me into gear. Suddenly, the seemingly mundane topic of art insurance transformed from a chore into a genuine act of care, a way to respect the art I've poured my heart and soul into creating or collecting, and yes, to protect that often significant investment. It's not just about the money; it's about the story, the emotion, the visual conversation each piece holds, and how insurance allows for its restoration or replacement. So, let's dive into why safeguarding your collection with a good insurance policy is less about paperwork and more about true peace of mind, and how to practically achieve it.

Why I Started Thinking About Art Insurance (Beyond Just "Because I Should")

My journey with art has always been deeply personal. Each brushstroke, each color choice, each piece I've brought into my studio or home, carries a weight of meaning. So, when I started seeing my collection as truly "valuable"—not just in a monetary sense, but in its irreplaceable essence—the idea of loss became more potent. It's akin to the worry you feel when a loved one is out of sight – that persistent 'what if.' I remember once, I accidentally left a window ajar during a sudden downpour, and for a terrifying minute, a drip was heading straight for a framed print. Crisis averted, but the cold dread lingered.

I used to think, "My art is safe here, I'm careful." But life, with its delightful chaos, often has other plans. I remember the time a sudden draft swung a heavy curtain rod just past a delicate ink drawing, or when an enthusiastic cat decided a canvas corner was a new scratching post. These small moments, thankfully averted, were like whispers of what could be, nudging me to acknowledge that even in the most protected spaces, unpredictability lurks.

And while I cherish the spontaneity of creation, I prefer my art collection to be a bastion of stability. Insuring my art became less about anticipating disaster and more about embracing responsibility and, quite frankly, sleeping better at night. It's about having a pragmatic plan for those 'what ifs' that quietly echo in the back of our minds. This realization led me to confront the very real, albeit sometimes unsettling, 'what ifs' that every art lover and creator must consider.

The "What Ifs" That Keep Us Up at Night (and What Insurance Can Do About Them)

When it comes to protecting what we love, our minds can conjure up a spectrum of potential disasters, from the mundane to the catastrophic. For art collectors and creators, these 'what ifs' are very real concerns:

- Accidental Damage: The dreaded slip, the unexpected drop, the curious pet, or even just a clumsy moment during a rehang in your studio. Believe me, it happens!

- Theft or Vandalism: A heartbreaking thought, but unfortunately, a reality for some. This can happen at home, in transit, or even at an exhibition.

- Natural Disasters: Fires, floods, earthquakes – forces of nature we can't control but can prepare for.

- Transit Damage: Moving a cherished piece, whether across town to a collector or across the globe for a gallery show, is inherently risky. Think about all those bumps and turns!

- Mysterious Disappearance: Sometimes things just... vanish. Was it misplaced during a hurried studio clean-up, perhaps accidentally swept up with packing materials for an exhibition, or a subtle theft without obvious signs of forced entry after a private viewing, leaving you to question your own memory? A robust policy can cover this too, offering peace of mind when there's no clear explanation, freeing you from that haunting 'where did it go?' question.

A specialized art insurance policy can act as a safety net for these scenarios, helping to cover the cost of repair, restoration, or replacement, so the emotional sting of loss isn't compounded by financial burden.

Decoding the Jargon: Key Terms You'll Encounter

Navigating the world of insurance can feel like learning a new language, filled with bewildering acronyms and nuanced terms. Feeling a bit lost in the insurance alphabet soup? Don't worry, I've stumbled through it, and I'm here to be your unofficial translator, highlighting the terms that truly matter for art owners and creators:

- Appraisal: This is essentially a professional assessment of your artwork's current market value. Think of it as getting a detailed report card for your art. It's crucial for determining how much your policy will cover. It's important to note that an appraisal for insurance purposes often focuses on replacement value, which is the cost to replace the item with a new one of similar kind and quality, and can differ significantly from an appraisal for sale, estate planning, or donation, which might focus on fair market value.

- Agreed Value vs. Actual Cash Value (ACV) / Market Value: This is a big one, perhaps the biggest, for art collectors and artists.

- Agreed Value: My personal preference for art. You and the insurer agree on a specific value for each piece before any loss occurs. This is paramount for art, as its value is often subjective, influenced by provenance, exhibition history, critical reception, and an artist's evolving career – factors hard to capture with standard market value alone, especially post-loss. If something happens, you get that agreed-upon amount (within reason, of course). While it offers certainty, insurers typically require a professional appraisal to validate this agreed value, ensuring it accurately reflects the art's market worth.

- Actual Cash Value (ACV) / Market Value: The insurer pays out the replacement cost minus depreciation. For art, which often appreciates or holds sentimental value that can't be depreciated, this can be incredibly tricky and lead to disagreements. Generally, ACV is best avoided for valuable art; it feels like trying to put a square peg in a round hole.

- Exclusions: These are the specific things your policy won't cover. They might include damage from insects, rodents, mold, or mildew (unless directly caused by a covered peril like a flood). Crucially, be aware of inherent vice, which refers to damage due to the artwork's own unstable or deteriorating nature – for example, certain pigments that degrade over time, unstable adhesives in a collage, or the natural embrittlement of some plastics used in contemporary sculpture. It’s damage that stems from the material itself, independent of external factors. Gradual deterioration, wear and tear, war, or nuclear hazards are also common exclusions (hopefully never a concern!). Always read this section carefully! It's like checking the ingredient list for something you're allergic to.

- Deductible: My least favorite word! This is the amount you have to pay out-of-pocket before your insurance kicks in. A higher deductible usually means lower premiums, but make sure it's an amount you're comfortable paying if disaster strikes. It's the cost of entry before your safety net unfurls.

- Blanket Coverage: An alternative option for collections of numerous pieces where individual values are lower or not yet fully appraised. Instead of itemizing each piece, you insure the entire collection for a single, overall amount. However, be mindful of per-item limits: a significantly valuable piece might be underinsured if its individual worth exceeds this limit. It's often a good starting point for emerging collections before specific pieces gain significant individual value, providing a collective layer of protection.

My Personal Checklist: Steps to Get Your Collection Covered

So, you're convinced, and perhaps a little like me, you're ready to stop procrastinating. Here's how I approached getting my art properly insured, with a few tips for your own journey:

1. Inventory and Documentation: Know What You Have (Really Know It!)

This is probably the most tedious but most important step. Trust me, I speak from personal experience – it's easy to lose track. I've even found sketches I'd completely forgotten tucked behind a stack of canvases and thought, 'Oh, hello there, old friend, you've been hiding!' For artists, this can be particularly challenging – we often live and breathe our work, sometimes blurring the lines between creation, storage, and display. But this upfront effort is your best defense, saving untold heartache and bureaucratic headaches later.

You need a detailed list of every piece you want to insure, including:

- Artist name

- Title of work

- Date of creation

- Medium (oil on canvas, acrylic on paper, sculpture, digital print, etc.)

- Dimensions

- A clear, high-quality photograph of the front and back.

- Any provenance documents (receipts, certificates of authenticity, exhibition history).

If you're looking for guidance on capturing your art digitally, I've actually put together some thoughts on how to photograph your art collection for insurance that might help you get started without too much fuss. And please, for the love of all that is art, keep digital copies of all this documentation – photos, appraisals, receipts – in a secure, off-site location like cloud storage or an external hard drive. Imagine losing your paper records and your art in the same disaster. My stomach clenches just thinking about it.

2. Valuation: What's It Really Worth?

Unless your art is hot off my easel (in which case, thank you, and let's talk!), you'll likely need a professional appraisal. For contemporary pieces or emerging artists, this might mean a gallery estimate or a specialized art appraiser. Don't guess. An accurate valuation ensures you're neither overpaying for premiums nor underinsured when you need it most. It's a bit like getting your car serviced; you trust the experts to tell you what's really going on under the hood. I remember the first time I had a significant piece appraised; I had my own idea of its worth, and the appraiser's number was... enlightening. It's a grounding experience, making the investment feel even more tangible. Remember, for insurance, we're often talking about replacement value, not necessarily what it might fetch at auction tomorrow.

The Artist's Dilemma: Valuing Your Own Work

As an artist, putting a monetary value on your own creations can feel... well, a bit like valuing a piece of your soul. It’s emotionally charged, and often, what a piece means to you isn't what the market (or an insurer) sees. Early career pieces might fluctuate wildly in value, and works-in-progress can be tricky. My advice? Get an objective professional appraisal. Even if the number surprises you (it often does!), it provides a crucial, unbiased baseline. For new works, a good starting point can be comparing to similar pieces by artists at a comparable stage in their career, considering materials, time invested, and initial gallery prices. It's a grounding experience, making the investment feel even more tangible. Once you have a clear picture of your collection's worth, the next crucial step is deciding on the right policy to protect it.

3. Choosing the Right Policy: Homeowners vs. Specialized Art Insurance

This is a critical distinction, especially for a serious collector or an artist. Your choice here impacts nearly everything. To truly understand the difference, let's break down the key distinctions between a standard homeowners policy and a specialized fine art floater:

Feature | Standard Homeowners Policy | Specialized Fine Art Floater Policy |

|---|---|---|

| Coverage Type | Limited, often "named perils" (fire, theft only) | "All-risk" coverage (covers almost everything unless excluded) |

| Valuation | Actual Cash Value (ACV) or Market Value | Agreed Value (you and insurer agree on value beforehand) |

| Coverage Limits | Often low per item or total collection cap | Higher limits, tailored to collection's worth |

| Transit Coverage | Rarely covers art in transit | Typically includes worldwide transit coverage |

| Deductible | Common, can be high | Options for low or no deductible |

| Restoration | Seldom covers restoration or conservation | Often includes conservation and restoration costs |

| Special Mediums | General policies don't cover specific art needs | Can be tailored with riders for delicate mediums (e.g., glass, textiles, fragile sculptures, digital art with specific hardware needs, even NFTs and their associated digital wallets) |

| Specialized Expertise | General claims adjusters, no art specialists | Staff often includes art historians, conservators, or art market experts |

For me, the comprehensive, tailored protection of a specialized policy was a no-brainer. The 'Agreed Value' system, in particular, offers such profound peace of mind. Art values can be so fluid, so subjective, and tied to emotional resonance. Knowing that a specific, agreed-upon amount is secured, rather than navigating subjective market interpretations after a loss, removes a layer of anxiety I simply don't want. If I'm going to invest my passion and resources into building a beautiful abstract art collection, and yes, even creating my art to share, I'm going to protect it properly.

How to Choose an Art Insurer (and What to Look For)

Choosing the right insurer is almost as important as choosing the right policy. Look for a provider who:

- Specializes in Art: Art insurance is a niche. You want a company and agents who understand the nuances of the art market, conservation, exhibition logistics, and the specific vulnerabilities of diverse mediums – from a delicate oil painting to a complex digital installation. Many even have art historians or conservators on staff.

- Has a Strong Reputation: Check reviews, ask for referrals from other collectors or galleries, and research their claims process. A smooth claims experience is priceless.

- Offers Flexibility: Can they tailor a policy to your specific collection, including unique mediums, exhibition loans, or changing values? Can they accommodate growth in your collection?

- Provides Excellent Customer Service: You want to be able to reach them easily and discuss changes or concerns without hassle.

Special Considerations for Loans and Exhibitions

Moving your art, or lending it for an exhibition, introduces new risks. A specialized fine art policy typically covers your art while it's:

- In Transit: Whether by professional art shippers or yourself.

- On Loan: To a museum, gallery, or private exhibition. This is crucial for artists like me, who might have works at the gallery in 's-Hertogenbosch or other venues. Lending a piece is always a mix of excitement and a tiny knot of worry; having robust insurance is what allows me to genuinely enjoy the thought of my art being seen elsewhere. Always inform your insurer of these arrangements before the move or loan. Don't assume the venue's insurance will fully cover your pieces; often, you need your own coverage to fill gaps, and it's vital to carefully review the terms of the loan agreement regarding insurance responsibilities and ensure they align with your policy.

4. Understanding the Fine Print: Read Those Exclusions!

Yes, I know, reading fine print is about as exciting as watching paint dry (unless it's my paint drying, then it's mesmerizing!). But seriously, understanding the exclusions is vital. It saves you from nasty surprises later. If something you're worried about isn't covered, you might be able to add a rider – an endorsement or amendment to your policy that extends coverage to specific items or risks not originally included. Don't be shy about asking your broker questions until you fully understand everything. After all, it's your art and your peace of mind we're talking about.

What to Do When a Claim Occurs: A Practical Guide (Just in Case)

While we hope these policies remain pristine and unused, it's equally important to know how to navigate the unfortunate event of a claim. No one wants to think about it, but knowing the steps for filing a claim can turn a chaotic moment into a manageable process. It's like having a fire drill; you hope you never need it, but you're glad you know what to do.

- Safety First: Ensure personal safety and prevent further damage to the art or property.

- Document Everything: Immediately photograph the damage, its location, and any contributing factors (e.g., burst pipe, broken window). Take notes on the date, time, and circumstances.

- Secure the Scene: If theft or vandalism, contact the police immediately and secure the area. Obtain a police report.

- Notify Your Insurer Promptly: Contact your art insurance provider as soon as possible. Delays can complicate the process. Be prepared with your policy number and initial details.

- Provide Documentation: Submit your detailed inventory, appraisal reports, purchase receipts, and all photos/notes you've collected. The more thorough your initial documentation, the smoother the claim will be.

- Do Not Dispose or Repair (Yet): Unless instructed by your insurer, do not dispose of damaged pieces or attempt repairs. The insurer may want to inspect the damage or arrange for their preferred conservator.

- Follow Up: Stay in communication with your adjuster, respond to requests for additional information promptly, and keep a record of all correspondence.

This process, while daunting, is significantly less stressful when you have a specialized art insurance policy that understands the unique value and needs of your collection.

Beyond the Policy: Everyday Protection Habits I've Adopted

Insurance is one layer of protection, but daily vigilance is another. It's like having a seatbelt and driving carefully. Here are a few habits I've cultivated to keep my art happy and safe:

- Environmental Control: Art hates extremes! Avoid direct sunlight (it fades colors, trust me, I've seen it), excessive humidity (hello, mold and warping!), and extreme temperature fluctuations. I try to be mindful of where I hang my pieces, sometimes sacrificing a "perfect" spot for one that's safer. For more on intelligent display, check out some thoughts on the art of display: how to light and position abstract art for maximum impact.

- Pest Control: Tiny creatures can cause monumental damage. Keep your art away from areas prone to insects or rodents, and consider regular, non-invasive checks, especially for pieces stored in less-trafficked areas. Those little munchers can be devastating!

- Careful Handling: Always handle art with clean hands, or even gloves. Avoid touching the surface of paintings. When moving, support from the bottom and cover to prevent scratches. It's not being precious; it's being respectful.

- Secure Display: Ensure hanging hardware is robust and properly installed. For larger, heavier pieces, consider professional installation. If you have art in high-traffic areas, think about its vulnerability. I've written about choosing art for high-traffic areas durability tips and durability, which might offer some useful insights.

- Smart Storage: If you rotate your collection or have pieces in storage, ensure they are properly wrapped (ideally with archival, acid-free materials like glassine or Tyvek, avoiding direct contact with plastics that can off-gas and damage surfaces) and stored in a climate-controlled, secure environment. Think of storage as a temporary home, and treat it with the same care.

Is It Really Worth It? A Final Thought

After all this talk about insurance, you might still be wondering: "Is it truly necessary for my collection, or for my journey as an artist?" And my honest answer is, if you cherish your art, if it holds significant personal or monetary value, if you pour your heart into creating it, and if the thought of losing it causes a pang of anxiety, then yes, it absolutely is.

Think of it as an extension of the care you already pour into your passion, a vital part of your artist's journey. Just as I invest my time and emotion into creating my art and sharing it with the world, insuring it is a practical manifestation of that same respect. It’s not just about protecting an investment, but about safeguarding the freedom to continue creating, to take risks, and to allow your work, or your collected pieces, to live fully without that constant gnawing 'what if' in the back of your mind. For me, that peace of mind? Absolutely priceless. It allows me to sleep, to dream, and to create with a lighter heart, knowing my artistic legacy is cared for. So, what's the next step for your collection or your studio? Perhaps it's time to start that inventory, or reach out for a specialized art insurance quote – a small step for a giant leap in peace of mind.

Frequently Asked Questions About Art Insurance

Q: Do I need insurance for a small collection or less expensive pieces?

A: It depends on what "less expensive" means to you and how much emotional value you place on the pieces. If even a small, affordable piece holds significant sentimental value or unique artistic merit, a specialized policy (even a small one) might be worth the peace of mind. For truly inexpensive items, your homeowners policy might offer enough basic coverage for "named perils," but it often lacks the comprehensive protection and specialized valuation for art. It's always best to consult with an art insurance specialist to weigh your options – they can help you understand the true risks and benefits for your specific situation.

Q: How often should I re-appraise my art?

A: Generally, it's recommended to have your art re-appraised every three to five years, or sooner if there's a significant change in the art market (a hot new trend, for example), if the artist's reputation suddenly rises (hello, emerging artists!), or if the piece undergoes major restoration. This ensures your "agreed value" remains accurate and you're not caught off guard by a market shift.

Q: What if I move my art or send it for exhibition? Is it covered?

A: Standard homeowners policies rarely cover art in transit. This is a key reason to opt for a specialized fine art floater policy, which typically includes transit coverage (often worldwide) for various scenarios, including moving, shipping by professionals, or loaning pieces for exhibition. Always inform your insurer before a major move or loan! Transparency here is your best friend.

Q: Is art insurance expensive?

A: The cost of art insurance varies widely depending on the total value of your collection, the types of pieces, where you live, and the specific terms of your policy (e.g., deductible, exclusions). While it's an added expense, many collectors find the premiums surprisingly reasonable, often ranging from 0.15% to 0.5% of the total insured value annually. This can be a small price to pay when compared to the potential financial and emotional loss. Get a few quotes from specialized providers to compare and find a policy that fits your budget and needs.

Q: If I'm an artist, does my studio or art-for-sale need special coverage?

A: Yes, absolutely! Your standard homeowners policy will likely not cover art stored in a studio, especially if it's considered a business premise or if the art is intended for sale. You'll typically need a separate commercial policy or a specialized fine art policy with specific endorsements for your studio space, materials, works-in-progress (which might have different valuation considerations than finished pieces), and finished pieces held for sale. This protects not only against damage but also against potential liability if a visitor is injured in your studio, or if a piece is damaged while being prepared for shipping to a client or gallery, like the gallery in 's-Hertogenbosch. Always discuss your specific artist needs with an insurance specialist; your art is your livelihood and your passion, and it deserves comprehensive protection.