How Are Art Galleries Funded? Unpacking the Money Side of the Art World

Ever wondered how art galleries stay afloat? Dive into the fascinating, often complex world of art gallery funding, from sales commissions to grants, and discover what truly keeps these cultural hubs thriving. My personal take on the business of art.

How Are Art Galleries Funded? Unpacking the Money Side of the Art World

I remember walking into my first really 'serious' art gallery – not a museum, but a commercial space, hushed and elegant, with art that felt both profound and, frankly, unattainable. My immediate thought wasn't just about the profound beauty or the challenging concepts on display, but this nagging question, loud in my mind: "How on earth do places like this, with their pristine walls and carefully curated silence, even exist financially?" It's a question I've heard countless times from fellow artists grappling with sustainability, from aspiring collectors trying to understand the market, and even from friends who just appreciate the beauty but are utterly baffled by the business side of things. You're probably wondering the same thing, aren't you? How do these bastions of culture, these elegant spaces, manage to sustain themselves?

This isn't just a casual curiosity; it's a fundamental query that underpins the entire creative economy. It's a question I've wrestled with, seen artists grapple with, and heard from collectors trying to navigate a market that can often feel like a secret society. But it's vital to pull back the curtain. Not just for transparency, mind you, but because truly understanding how galleries are funded is understanding a monumental piece of the puzzle that supports artists, shapes careers, fosters cultural dialogue, and ultimately brings art to the world. It’s about grasping the very backbone of how art, in its myriad forms, moves from the studio to the public eye, impacting both individual lives and collective consciousness.

Believe me, it's rarely as simple as just selling pretty pictures. In fact, the art world, with its multi-billion dollar annual turnover, is a fascinating, complex ecosystem of passion, commerce, and relentless dedication. This article aims to be your definitive guide, a deep dive into the diverse and often surprising financial models that underpin the very existence of art galleries, from the gleaming commercial spaces to the grassroots artist-run initiatives. We'll unpack the money side, together, exploring everything from direct sales and intricate commission structures to government grants, corporate sponsorships, and the emerging digital frontier. Let's clear up some of the mystery I've personally encountered over the years and get a comprehensive picture of how these vital cultural institutions thrive.

The Diverse Landscape of Art Galleries: More Than Just Showrooms

Before we dive into the fascinating, sometimes bewildering, specifics of how money flows, I think it’s crucial to understand that "art gallery" isn't a single, monolithic entity. Just as there are countless artistic styles and mediums, there are many kinds of galleries, each with slightly different missions, operational models, and, consequently, distinct funding strategies. My focus here is primarily on commercial galleries, as they represent the most common entry point for many artists and collectors into the market. However, it's vital to keep the broader landscape in mind, because these diverse spaces are all interconnected. I often think of the gallery world as a vibrant, multifaceted spectrum, ranging from the highly entrepreneurial to the purely philanthropic, each serving a unique, indispensable role in the broader art ecosystem. Just as every artist has a unique voice, every gallery has a distinct financial heartbeat – a unique blend of passion, mission, and pragmatic business strategy. And believe me, understanding that heartbeat is absolutely crucial.

Understanding these distinctions is key because, as we'll soon discover, the source of funding often dictates a gallery's mission, its operational style, and its very definition of success. It shapes everything from the art they show to how they interact with artists and collectors. Without understanding this foundational aspect, you're only seeing half the picture – the beautiful facade, but not the intricate machinery behind it, the real engine that keeps the art world turning. To truly appreciate the nuances of gallery funding, it helps to first map out this diverse terrain. Each type of gallery operates with a unique set of financial drivers and cultural objectives. From the bustling, profit-driven hubs of the commercial market to the quiet, mission-led spaces of public institutions, their funding structures are as varied as the art they champion. It’s a complex tapestry, and each thread is vital. Here's a quick, comparative look at the diverse roles and funding foundations within the gallery world, a snapshot of the terrain we're about to explore:

Gallery Type | Primary Mission | Main Funding Sources | Key Characteristic |

|---|---|---|---|

| Commercial Galleries | Art sales, artist careers, market development | Art sales (commissions, direct purchases) | Profit-driven, market-oriented, artist representation |

| Non-Profit/Public | Cultural enrichment, education, public access | Grants, donations, government funding, endowments | Mission-driven, community-focused, educational |

| University Galleries | Academic support, research, student/faculty exhibits | University budget, grants, donations | Educational, often experimental, academic integration |

| Artist-Run Spaces | Experimental platforms, artist community | Grants, shared fees, small sales, donations | Grassroots, artist-centric, flexible programming |

| Pop-up Galleries | Temporary sales, market testing, events | Short-term sales, event fees, sponsorships | Agile, temporary, market-responsive, low overhead |

| Online Galleries | Digital art sales, global reach | E-commerce sales, subscriptions | Digitally native, broad accessibility, lower physical overhead |

| Co-operative Galleries | Shared costs, collective representation | Member fees, shared sales commissions | Artist-owned, collaborative, communal support |

Commercial Galleries: The Market Drivers

These commercial entities are often seen as the bread-and-butter of the art market, the bustling engines driving much of its financial activity. They are businesses first and foremost, undeniably driven by sales. But to call them just businesses would be incredibly reductive. They are often run by individuals with an almost evangelical passion for art, visionaries who discover artists, nurture careers over decades, and meticulously connect art with collectors, all while navigating the often-treacherous, deeply personal waters of commerce. It's a high-stakes balancing act of passion and profit. Within this broad and competitive category, which is often mistakenly viewed as a single, monolithic entity, you'll primarily find distinct operational models that cater to different segments of the art market. These are the engines that drive much of the art world's commerce and cultural exchange, fueled by both passion and astute business acumen. You'll primarily find:

- Primary Market Galleries: These are the frontline innovators, the scouts and champions of contemporary art. Primary market galleries exclusively represent living artists, introducing fresh, new work directly from the artist's studio to the market. They are the initial, crucial touchpoint for an artist's career, often investing deeply in their development—sometimes even providing studio space, stipends, or production funding! They offer critical exposure, strategic marketing, and help to establish an artist's market presence and legacy. Think of them as talent scouts, career builders, and sometimes, vital artistic patrons. Their financial model relies heavily on the discovery, rigorous vetting, and long-term promotion of new talent, and they typically manage exclusive artist representation contracts that can define an artist's entire career. Think of it: a gallery might scout an artist right out of art school, nurturing their practice, providing crucial early sales, and strategically placing their work in significant collections. This is a monumental, long-term investment, far beyond mere transactions, creating a true partnership that can span decades and build a lasting legacy. I've often seen these relationships blossom into something truly special, a testament to mutual trust and a shared vision for an artist's journey.

- Secondary Market Galleries: These spaces operate in the resale market, dealing in artworks that have been previously sold. They often focus on established artists, blue-chip works, or historical periods, acting as sophisticated brokers for collectors looking to buy or sell existing pieces. This segment requires deep expertise in art historical knowledge, meticulous provenance research (the documented history of an artwork's ownership, absolutely crucial for establishing authenticity, legal title, and market value, and something I cannot stress the importance of enough), and acute market valuation skills. I've heard stories of incredible finds—like a forgotten masterwork turning up in an attic—but also of costly misjudgments in this high-stakes arena where a single misstep can be financially catastrophic. It’s a world of connoisseurship, negotiation, and high-level risk assessment, demanding a truly forensic approach to art history and market intelligence. Imagine the detective work involved in tracing an artwork's journey through centuries; it's a fascinating, if sometimes daunting, challenge.

- Hybrid Galleries: Increasingly common, many galleries deftly operate in both primary and secondary markets. This hybrid model allows them to balance the exciting, but often riskier, development and promotion of new talent with the more stable, yet fiercely competitive, revenue streams generated by reselling established, proven works. It's a strategic dance to diversify inventory, mitigate the inherent risks of a volatile art market, and offer a broader range of artists and price points to a diverse client base. This flexibility is a hallmark of truly resilient gallery models today, allowing them to adapt to market shifts and client demands with a remarkable agility. For instance, if the contemporary art market faces a slowdown, a hybrid gallery can lean more heavily on the resale of established, blue-chip works, providing a crucial buffer against volatility. It’s a smart strategy for long-term survival in an often-unpredictable industry. I've personally seen this adaptability be the key differentiator between galleries that thrive and those that struggle to stay afloat.

Non-Profit & Public Galleries: Mission-Driven Spaces

These institutions, which often include many major museums (and while this article isn't solely about how-are-museums-funded specifically, the underlying principles of their financial models are strikingly similar), fundamentally prioritize cultural enrichment, education, and public access over profit. Their very existence is predicated on a mission-driven approach, serving the public good, fostering critical dialogue, and preserving our collective artistic heritage. Consequently, their funding models lean heavily on philanthropy, broad public support, and a complex, often competitive, web of grants and public funding. I see these as the guardians and purveyors of our collective artistic heritage, making art accessible and meaningful to everyone. Their success isn't measured in sales figures, but in cultural impact, community engagement, and the enrichment of public life. They are the bedrock of broad artistic appreciation and often the first point of contact for many with the world of art. It’s a beautiful thing, this commitment to the public good, a profound belief in art's intrinsic value beyond its commercial worth.

- University Galleries: Often integral components of academic institutions, university galleries play a dual, invaluable role. They deeply support art education and research within the university curriculum, while also showcasing the work of students, faculty, and visiting artists. They frequently offer highly experimental programming, fostering critical dialogue and academic engagement with contemporary art, often pushing conceptual boundaries in ways commercial galleries, beholden to market demands, cannot. I've always found these spaces to be breeding grounds for fresh ideas, offering a vital platform for academic integration, interdisciplinary research, and the unbridled exploration of new artistic frontiers. They act as critical laboratories for art, allowing for conceptual rigor and intellectual freedom that can sometimes be constrained by the commercial imperative. Here, the emphasis is firmly on pedagogy and pushing boundaries, rather than marketability. They are often where the next most-important-artists are first discovered, acting as crucial launchpads for innovative practices that might one day reshape the art world. I see them as essential for the intellectual and conceptual growth of art.

- Artist-Run Spaces: These are the quintessential grassroots efforts, born from the urgent need for artists to create their own exhibition and community platforms. They are often highly experimental, providing vital spaces for emerging or underrepresented voices who might find traditional gallery entry challenging or intimidating. Operating on shoestring budgets, their funding typically comes from small, project-based grants (often applied for by artists themselves using guides like how-to-write-an-artist-grant-proposal), shared membership fees, volunteer labor, and often, the artists' own pockets. I've always admired the sheer determination and collaborative spirit that fuels these spaces; they are truly artist-centric, community-driven, and often serve as crucial incubators for future trends and talents, operating with an inspiring independence. For artists struggling to find traditional representation, these spaces offer a vital stepping stone, a place to experiment and connect with peers and nascent collectors. If you're an artist looking for such opportunities, exploring resources like how to find galleries accepting new artists can be a crucial first step, or even checking out top-online-resources-for-emerging-artists. Their agile nature often allows them to be at the forefront of new movements, much like the early days of ultimate-guide-to-cubism or ultimate-guide-to-neo-expressionism, pushing boundaries and challenging conventions. I see them as the beating heart of the independent art scene.

- Public Art Galleries: Primarily funded by government bodies (local, regional, or national) or established public trusts, these institutions are explicitly mandated to make art accessible to all citizens. They frequently focus on regional artists, historical narratives, or specific cultural themes, acting as custodians of public artistic heritage and fostering civic engagement through art. Their funding ensures that art remains part of the public commons, a vital resource for everyone, regardless of their economic status. They are instrumental in fostering civic pride, preserving local history, and providing accessible cultural experiences that enrich the lives of entire communities. It's truly art for all, sustained by public will and communal investment. I've always believed that public galleries are a cornerstone of a healthy, culturally rich society, offering spaces for reflection and inspiration for everyone, regardless of their background. They embody the idea that art is a shared human right, a communal resource that enriches us all.

Emerging Models: Pop-ups, Online Platforms, and Cooperatives

The art world is by no means static; it's a vibrant, constantly evolving landscape. New models are constantly emerging, blurring the lines and challenging traditional structures, often in response to technological shifts, economic pressures, or a desire for greater accessibility and equity. These innovative approaches provide vital alternative pathways for artists and offer fresh experiences for audiences. Let's explore some of these exciting, and sometimes disruptive, models that are continually reshaping the art world's financial topography. These innovations often arise from a desire for greater flexibility, lower overheads, or a more direct connection with artists and audiences, demonstrating the inherent adaptability and entrepreneurial spirit of the art market:

- Pop-up Galleries: These agile, temporary spaces allow galleries to test new markets, reach diverse audiences, or host specific, impactful events without the substantial overheads associated with a permanent physical location. They're a dynamic, responsive solution to evolving urban landscapes and offer unparalleled flexibility in programming, often creating a sense of urgency and exclusivity around a brief engagement. I've seen some incredibly creative pop-ups, transforming unexpected spaces—from disused storefronts to industrial warehouses—into vibrant, temporary exhibition venues for a brief, yet impactful, period. Their low overhead can translate into greater artistic freedom and higher artist shares, making them an attractive option for both emerging artists and galleries looking to experiment with new exhibition formats or locations. I've witnessed pop-ups transform unexpected urban spaces, creating a buzz that a permanent gallery might struggle to replicate. They are the guerilla marketers of the art world, agile and impactful, a clever way to bypass the prohibitive costs of permanent real estate. I've seen everything from abandoned storefronts to industrial lofts temporarily transformed into vibrant art destinations, proving that sometimes, the most exciting art experiences are also the most fleeting.

- Online Galleries: These are dedicated e-commerce platforms primarily focused on selling art digitally. Their funding derives almost entirely from sales, and their business model often boasts significantly lower overheads compared to traditional brick-and-mortar spaces, enabling greater global reach and sometimes more competitive pricing. They've democratized access to art for many, allowing collectors from anywhere in the world to discover and purchase art with unprecedented ease. This model has truly reshaped the art market, challenging established hierarchies and creating new opportunities, as explored in articles like the-rise-of-digital-abstract-art-a-new-frontier-for-collectors. The investment in robust digital infrastructure, however, is a significant, ongoing cost, encompassing everything from high-resolution image hosting to secure e-commerce systems, immersive virtual viewing room technologies, and even AI-powered recommendation engines. They’re effectively digital storefronts, demanding constant technological updates and a sophisticated understanding of online user experience. This pivot to digital has also opened doors for new art forms, such as those discussed in the role of AI in art curation: opportunities and challenges for galleries and collectors. The success of online galleries hinges on their ability to cultivate trust and provide a compelling virtual experience, often through high-quality photography, virtual viewing rooms, and detailed provenance information. It's a fascinating blend of art and tech, constantly pushing boundaries.

- Co-operative Galleries: In these truly collaborative models, artists collectively own and operate the exhibition spaces. They share costs, responsibilities, and often take significantly smaller commissions, or even none, on sales, fostering a more equitable distribution of revenue back to the creators themselves. It's a true community-driven approach to art presentation, providing artists with greater control over their exhibition and sales process, often allowing for more experimental or politically engaged work. This democratic structure empowers artists and builds a strong, supportive communal network, fostering a sense of shared ownership and collective responsibility. It's a powerful model for mutual aid and self-determination within the often-hierarchical art world, allowing artists to directly influence their exhibition contexts and financial outcomes. These spaces often rely on shared labor, minimal overhead, and a collective vision, making them resilient in the face of market pressures. I've always admired the tenacity and camaraderie that define these artist-led initiatives; they truly embody a spirit of artistic autonomy.

- Vanity/Rental Galleries: While often viewed with skepticism by the mainstream commercial art world, it’s important to acknowledge "vanity" or "rental" galleries. In this model, artists pay an upfront fee to exhibit their work. While they offer exhibition opportunities, they operate on a fundamentally different principle than traditional commercial galleries, which invest in their artists and earn through commissions. For emerging artists, they can provide a platform, but it's crucial to understand the distinction and weigh the costs against the potential exposure. I’ve heard many artists grapple with the decision of whether or not to engage with these spaces, as the financial model shifts the risk entirely to the artist. It's a model that sometimes raises eyebrows within the established art world due to this fundamental difference in risk assumption, and I personally advise caution and thorough due diligence for any artist considering this path.

Now, let's zoom in on the primary drivers for most commercial art spaces. This is where the rubber meets the road, where artistic vision tangles with market realities, and where the financial heartbeat of the gallery world truly pulses. It’s a high-stakes balancing act, demanding intuition, negotiation, and an unwavering belief in the power of art.

The Core Business Model: Sales, Sales, Sales (Mostly)

At the pulsing heart of most commercial art galleries – the kind I'm primarily thinking about here, the ones that anchor the global art market – is a seemingly straightforward, yet brutally competitive, model: selling art. It might sound deceptively obvious—art is sold, money is made. But the devil, as they say, is in the details, and the nuances of this model are where it gets truly interesting, complex, and, frankly, often quite precarious. It's not just about finding a buyer; it's about cultivation, strategic market positioning, impeccable reputation, and often, a touch of genuine magic. It's a world where long-term relationships are as valuable as a masterpiece.

The Art of Pricing: Setting Value in a Subjective Market

Before diving into the specifics of how money changes hands, it's worth a moment to consider how a gallery actually values the art it sells. This isn't like pricing a commodity; it's a delicate, intricate balance of deep art historical knowledge, rigorous market science, and a finely tuned intuition developed over years of experience. Factors like the artist's reputation, their extensive exhibition history, critical acclaim and scholarly recognition, current market demand, the artwork's meticulous provenance (documented ownership history, which is paramount for authenticity and value), its physical condition, and comprehensive comparable sales data all play a crucial, interwoven role. Galleries constantly research current market trends, often consult with independent art appraisers (a topic fascinatingly explored in understanding-art-appraisals-what-every-collector-needs-to-know), and work closely with artists to ensure pricing is not only competitive but also reflective of the piece's intrinsic cultural value and aligned with the artist's long-term career trajectory. It’s a transparent, strategic process designed to build enduring confidence for both artists and collectors. Often, this involves comparing a new piece to similar works by the same artist or by artists of comparable standing, considering exhibition history, and even anticipating future market trends. This isn't a shot in the dark; it's a meticulously calculated decision that impacts careers and collections alike. I've often seen gallerists spend hours, if not days, agonizing over the perfect price point, understanding that it's a reflection of both artistic integrity and market strategy. This isn't just about a number; it's about building a sustainable career for an artist and establishing a trusted relationship with a collector. Understanding this valuation process is key for any aspiring collector, and something truly explored in resources like understanding-art-appraisals-what-every-collector-needs-to-know.

Commission-Based Sales: The Bread and Butter

For many commercial galleries, particularly those representing living artists, the primary, indeed foundational, income stream comes from commission-based sales. This means when a piece of art is sold, the gallery takes a predetermined percentage of the sale price, and the artist receives the remainder. I’ve had countless conversations with artist friends agonizing, quite understandably, over this split. While a 50/50 division is often considered the industry standard, it's far from universal. The exact percentage can vary significantly, often reflecting a complex negotiation of value; emerging artists, needing more intensive support and exposure, might accept a slightly lower share, while very established artists with immense market pull and a proven track record might command a more favorable split. Factors like the gallery's significant operational overheads, the artist's direct involvement in bringing a client to a sale, or even the type of artwork (e.g., limited editions versus unique, large-scale pieces) can also profoundly influence these crucial negotiations. To give you a clearer picture, it’s worth noting that this isn't a fixed equation but a fluid negotiation. The final split often reflects the gallery's significant investment in time, resources, and reputation. Here are some common factors that sway that crucial percentage, shaping the financial partnership between artist and gallery:

Factor | Impact on Artist's Share | Rationale |

|---|---|---|

| Artist's Reputation | Higher for established artists | Proven market, strong demand, less gallery "risk" |

| Gallery's Prestige | Lower for emerging artists | Gallery offers significant exposure & career building |

| Artwork Type | Varies (e.g., editions vs. unique) | Editions may have different splits due to volume/production costs |

| Artist Involvement | Higher if artist brings client | Reduced gallery sales effort for that specific transaction |

| Gallery Overheads | Can push for lower artist share | High operational costs need to be covered |

| Exclusivity Agreement | Can be negotiated for favorable terms | Artist commits solely to one gallery, increasing gallery investment |

It’s a partnership, really—a deeply symbiotic relationship. The gallery provides the coveted physical or digital exhibition space, the strategic marketing and public relations, an invaluable global client network, the expertise in handling complex transactions, meticulous art handling and secure shipping logistics, and often the crucial validation that helps an artist's career grow exponentially. They invest significant time, financial resources, and their hard-won reputation into the artists they represent, sometimes even offering advances for new work or funding for specific ambitious projects. In return, they get a slice of the pie. Without sales, of course, there's no pie for anyone. Simple, right? But the constant, often relentless, pressure to find buyers, cultivate relationships, and ensure a steady flow of high-quality, engaging art is immense. I've seen gallerists burn the candle at both ends, constantly on the lookout for fresh talent and the next big show, pouring their entire beings into the endeavor. This dedication is what transforms a simple commercial transaction into a thriving cultural enterprise. If you're curious about that side of things, our article on qa-with-a-gallerist-on-discovering-new-talent offers a more intimate peek behind that curtain. It's a true ecosystem of mutual dependence.

Retainer or Stipend Models: Building Stability

While certainly less common, a select few galleries, particularly those with very stable funding or an unwavering belief in a long-term artistic vision, might offer artists a retainer or stipend. This provides a crucial, guaranteed income stream to the artist, allowing them to focus solely on creating and experimenting without the immediate, paralyzing pressure of sales. In return, the gallery often secures a larger percentage of future sales or exclusive rights to the artist's entire output for a specified period. This model is a significant, high-risk investment by the gallery, demonstrating deep commitment and acting as a form of patronage, and is often reserved for artists with a proven track record, immense potential, or those working on highly ambitious, time-consuming projects. It's a testament to a gallery's deep belief in an artist's long-term trajectory, moving beyond mere transactional sales to a more profound, supportive patronage model. I've personally seen this model truly free up artists to produce their most innovative and ambitious work, unburdened by short-term financial concerns. It’s a rare and often aspirational arrangement, usually reserved for established artists or those with extraordinary, proven potential, demonstrating a gallery's deep commitment that transcends immediate transactional thinking. It's patronage in its most direct, contemporary form. This model allows artists to pursue ambitious projects that might not have immediate commercial appeal but contribute significantly to their artistic development and legacy, ultimately benefiting the gallery's prestige and long-term investment. It's a testament to a gallery's belief that some artistic endeavors need time, space, and unwavering support to truly flourish.

Direct Sales and Inventory Management

Sometimes, a gallery isn't just operating on a commission-only basis. They might strategically purchase art outright from an artist, especially if they have an unwavering belief in their long-term potential, or if the artist expresses a preference for an upfront payment. This represents a higher financial risk for the gallery, as they're investing their own capital and tying it up in inventory, but it also means they retain 100% of the profit when the piece eventually sells. This direct acquisition allows the gallery greater flexibility in pricing and marketing, and can provide a crucial lifeline for artists needing immediate funds for materials or studio rent. I've often seen this approach foster incredibly strong, long-term relationships between a gallery and an artist, built on mutual trust and shared risk, laying the groundwork for a truly collaborative and enduring partnership.

Furthermore, many commercial galleries dabble extensively in the secondary market, strategically acquiring pieces from private collectors, estates, or even other galleries. These works, often by more established artists or those with significant historical importance, are then meticulously cleaned, authenticated, and prepared for resale at a higher price. This segment demands a truly keen eye for market trends, impeccable art historical knowledge, and expert assessment of condition. It also requires rigorous provenance research—the documented history of an artwork's ownership, which is absolutely crucial for establishing authenticity, legal title, and ultimately, market value. As I've heard countless stories of misidentified or poorly conserved pieces, I can tell you this can be a genuine minefield! The gallery's ability to accurately assess both the intrinsic artistic value and current market demand for these works is paramount, often relying on a team of seasoned art market analysts or decades of accumulated, hard-won expertise from the gallerist themselves. This also involves navigating ethical considerations, particularly when dealing with art that might have complex origins. For insights into this, articles like ethics-of-art-collecting are invaluable. It's a high-stakes game of knowledge, timing, and a deeply cultivated network of trusted sources, where a single misjudgment can lead to significant financial loss and reputational damage. It’s a world where reputation and trust are built over decades, and can be shattered in an instant.

Consignment Agreements: A Delicate Balance

It's worth noting that much of the art held by commercial galleries is actually on consignment. This means the artist retains legal ownership of the artwork, and the gallery acts as an agent, holding the art and selling it on the artist's behalf. The gallery only earns its commission if—and only if—the work sells. This arrangement significantly reduces the financial risk for the gallery (they don't buy the art outright, thus avoiding tying up capital in inventory). For the artist, it's a vital way to get their work exhibited and sold without bearing the full burden of marketing and sales, or the overhead of a physical space. Clear, legally sound consignment agreements are absolutely fundamental to these relationships. These detailed contracts meticulously outline everything from the duration of the exhibition, responsibilities for insurance (often covering 'nail-to-nail' transit and display, protecting against damage or loss), specific marketing efforts, return policies, and, of course, the agreed-upon commission split. A well-drafted agreement protects both parties, defines expectations, and fosters a relationship built on trust and mutual understanding. I've heard enough horror stories—about miscommunications, disputed ownership, or lost works—to know that having everything in writing is not just good practice, it's a lifeline. Beyond the legalities, a good consignment agreement clearly defines the scope of the gallery's responsibilities, from promotion to installation, ensuring both artist and gallerist are on the same page. It establishes trust and legal clarity, which is paramount in a business dealing with such high-value, often irreplaceable, assets. This level of meticulous documentation is a non-negotiable aspect of professional gallery operations. I personally view a solid consignment agreement as the foundation of a healthy, long-term artist-gallery partnership.

I often think of these interactions, the quiet conversations over art, as the real engine of the gallery world – building relationships that transcend mere transactions.

Art Fairs and Exhibitions: The High-Stakes Arenas

If a gallery's consistent bread and butter are daily commissions from their physical or online space, then art fairs are often the champagne and caviar—high reward, yes, but also incredibly high risk, akin to a high-stakes gamble. These events are massive undertakings, requiring monumental logistical precision and financial outlay. Imagine the sheer orchestration required: securing a prime booth location, which alone can run into thousands or even tens of thousands of euros for just a few days; the intricate dance of shipping fragile, invaluable art across cities, continents, or even oceans; ensuring meticulous customs documentation; arranging travel and accommodation for an entire team; designing and producing bespoke marketing materials; and, of course, acquiring specialized, comprehensive art insurance to cover every potential mishap. The list, believe me, goes on and on. It's a temporary mini-museum, constructed with immense precision and financial commitment. The energy is electric, yes, but so is the anxiety. For a deeper dive into this intricate logistical dance, you might find our guide on understanding art fair logistics: a guide for emerging artists insightful.

I've personally seen galleries invest heavily, pouring their resources into a major international fair, only to come back with disappointingly minimal sales. It’s an undeniable gut punch, a brutal reminder of the market's capriciousness. The pressure to simply make back the enormous initial investment, let alone turn a meaningful profit, is immense. However, when a fair pays off, it really pays off. A single successful fair can sometimes provide a significant, even foundational, portion of a gallery's annual revenue, transforming its financial outlook for the entire year. Beyond direct sales, fairs offer unparalleled exposure, a concentrated environment for networking with influential figures like curators, critics, and fellow gallerists, and a crucial opportunity to meet new collectors from around the globe—a reach a gallery might struggle to achieve from its brick-and-mortar space alone. Many shrewd galleries also leverage fairs for strategic pre-sales to VIP clients or engage in intensive post-fair follow-ups that convert initial interest into significant, long-term relationships. Fairs also serve as vital testing grounds for new artists and works, allowing galleries to gauge public and critical reception on a global stage. For a deeper dive into this intricate logistical dance, you might find our guide on understanding-art-fair-logistics-a-guide-for-emerging-artists insightful. And if you're an artist looking to break into the scene, places like top-online-resources-for-emerging-artists can provide invaluable guidance for navigating these high-pressure environments. The strategic decision of which fairs to attend, and with which artists, is a high-stakes chess game that requires acute market intelligence and a touch of artistic foresight.

I've seen the energy at a major art fair described as electric, a concentrated burst of artistic and commercial activity that can make or break a gallery's year. It's a grueling but often exhilarating experience that demands both physical stamina and sharp business acumen.

Here’s a quick look at the high-stakes gamble of art fairs:

Aspect | Benefits | Risks & Costs |

|---|---|---|

| Exposure | Global audience, new collectors, media attention | Competition from thousands of other galleries, getting lost in the crowd |

| Sales | High-volume potential, significant revenue injections | High booth fees, shipping, travel, accommodation, staff costs, insurance |

| Networking | Connect with curators, critics, other gallerists, major donors | Time-consuming, no guarantee of meaningful connections |

| Market Trends | Gauge public interest, identify emerging artists/styles | Misjudging trends can lead to unsold inventory and financial losses |

| Brand Building | Elevate gallery's profile, associate with prestigious events | Poor presentation or low sales can damage reputation |

Diversifying Revenue: Beyond the Primary Market

Smart galleries know that relying solely on the often-unpredictable fluctuations of primary market sales is, quite simply, a precarious game. The truly resilient ones proactively diversify their income streams, building a more robust and sustainable financial structure that can withstand market volatility. It’s like having multiple tributaries feeding your river, ensuring a continuous flow even if one source temporarily diminishes. This strategic foresight, this constant search for new avenues of support, is what separates the thriving from the merely surviving in a demanding industry. It's about building a robust financial ecosystem, capable of weathering the inevitable storms of market fluctuations and evolving cultural trends. Those who only rely on one stream often find themselves struggling when that stream runs dry.

Curatorial Sales and Strategic Partnerships

Beyond direct sales from exhibitions, galleries often engage in curatorial sales, where they proactively place artworks with private collectors or institutions based on specific acquisition criteria or collection themes. This isn't just waiting for someone to walk in; it's an active, informed process that leverages the gallery's deep expertise, extensive network, and understanding of a collector's vision. Furthermore, many forge strategic partnerships with interior designers, architects, and luxury brands. These bespoke collaborations can lead to commissions for specific site-specific projects, art placement in high-end residential or commercial developments (think about how a significant artwork can transform corporate lobbies or luxury hotels), or even joint marketing initiatives that introduce the gallery's artists to new, affluent audiences. These cultivated relationships provide a valuable pipeline of sales outside of the traditional exhibition cycle, often cultivating long-term patrons and expanding the gallery's influence. For example, a partnership with a prominent architectural firm might lead to regular art commissions for new luxury developments, introducing the gallery's artists to an entirely new, affluent audience beyond traditional collectors. It’s about being proactive and creatively connecting with diverse industries, turning what might seem like disparate fields into fertile ground for artistic endeavors. These partnerships often provide a more predictable revenue stream compared to the sometimes erratic nature of exhibition sales. I've always found it fascinating how art, when strategically placed, can elevate a space, making these collaborations incredibly potent.

Consulting and Advisory Services

Collectors, especially new ones, often need guidance. Galleries, with their deep market knowledge and access to artists, can offer art consulting and advisory services. This might involve a comprehensive suite of services: helping a nascent client build a cohesive, meaningful collection from scratch, meticulously sourcing specific pieces (even if they’re not currently within the gallery’s immediate roster), conducting rigorous due diligence on potential acquisitions (including provenance, condition, and market value), providing expert guidance on managing and maintaining existing collections, or even assisting with navigating the complexities of understanding-art-appraisals-what-every-collector-needs-to-know. For these specialized services, a fee is charged, providing collectors with expert, often unbiased, advice. This can be especially vital for navigating the ethical complexities of certain acquisitions, a topic we touch on in ethics-of-art-collecting. For the gallery, it adds a valuable, often more predictable, revenue stream that powerfully leverages their deep market knowledge and relationships, all without relying on a physical artwork sale. It transforms expertise into income, recognizing that knowledge itself is a valuable commodity. This also extends to advising on complex topics like art authentication, helping collectors avoid pitfalls like those discussed in collecting-emerging-abstract-art-a-guide-to-discovering-tomorrows-masters and those concerning forgeries in specific markets. This specialized advice builds immense trust and loyalty, reinforcing the gallery’s position as an indispensable resource, not just a seller of art. I've seen how a trusted advisor can be the bridge between a hesitant new collector and a significant acquisition, transforming a casual interest into a lifelong passion, and often leading to deeper engagement with the gallery's own roster of artists.

Art Rental & Leasing Programs

Some galleries offer innovative art rental or leasing programs, particularly attractive to corporate clients, interior designers, film sets, or even private individuals looking to refresh their spaces without the long-term commitment of purchase. Companies, for example, might lease a curated selection of artworks for their offices, refreshing them periodically to keep their environment dynamic, inspiring, and aligned with brand values. It’s a smart way for galleries to generate recurring income from their inventory without having to sell the pieces outright, ensuring a continuous return on their investment and effectively leveraging their assets. For the clients, it offers incredible flexibility, access to high-quality art, and potential tax benefits. It’s a genuine win-win, introducing high-quality art to a broader, often corporate, audience who might not otherwise engage with the art market, potentially cultivating them into future collectors. I've personally seen offices transformed by rotating art collections, injecting dynamic energy into corporate environments and sparking conversations. It’s a savvy way for businesses to enhance their brand image, support the arts, and provide a stimulating environment for their employees, all while the gallery generates consistent revenue from its valuable inventory without permanent divestment. It’s a brilliant example of leveraging assets for recurring income and wider audience engagement. This model not only provides financial stability but also serves as an excellent entry point for new collectors, allowing them to live with and experience art before making a significant purchase. I even know of some residential buildings that offer art leasing as a perk, making art truly part of everyday luxury.

Art Licensing

In an increasingly digital and brand-conscious world, art licensing has emerged as another intelligent revenue stream for galleries and the artists they represent. This involves granting permission for an artwork's image to be used on various commercial products—from high-end textiles and home decor to stationery, apparel, or even digital media. The gallery, acting on behalf of the artist, negotiates licensing agreements, collects royalties, and manages the intricate details of intellectual property. This expands an artist's reach far beyond traditional collecting, turning their imagery into a ubiquitous presence that builds broader recognition and provides a scalable, passive income stream. It’s a smart way to monetize creative assets without selling the original work, and something many artists are increasingly exploring as detailed in our guide on how-to-license-your-art. This not only generates revenue but also broadens the artist's audience, potentially drawing new collectors to their original works, creating a virtuous cycle of visibility and sales. Imagine seeing a piece of art you love on a scarf, and then discovering the artist's original work in a gallery – that's the power of licensing.

Publications and Merchandise

Exhibition catalogs, detailed artist monographs, and limited edition prints are another potent way to monetize intellectual property and artistic connections, extending the gallery's reach beyond its physical walls. I, for one, absolutely love a beautifully produced artist book – they're collectors' items in their own right, providing deep insights into an artist's practice. Many galleries now have small, curated gift shops or robust online stores selling these items, along with branded merchandise like high-quality posters, postcards, or even unique artist-designed objects. It’s a way for enthusiasts and budding collectors to take a piece of the gallery experience home, connect more deeply with an artist's oeuvre, and support the gallery, even if a full-scale painting is out of reach. On that note, if you’re curious about exploring some vibrant, contemporary art prints, you know where to buy. This entire category transforms the ephemeral exhibition experience into tangible, purchasable objects, effectively extending the gallery's brand and the artist's reach, while also serving as an accessible entry point into the art market for new audiences. It democratizes access to art, allowing a broader public to own a piece of the creative world. This approach ensures that the gallery's influence and the artist’s work resonate with a wider demographic, cultivating future collectors and deepening cultural engagement. Beyond direct sales, these items also serve as powerful marketing tools, reinforcing the gallery's brand and mission. I've always found a well-produced exhibition catalog to be an invaluable resource, a lasting record of an artistic moment.

Educational Programs & Events

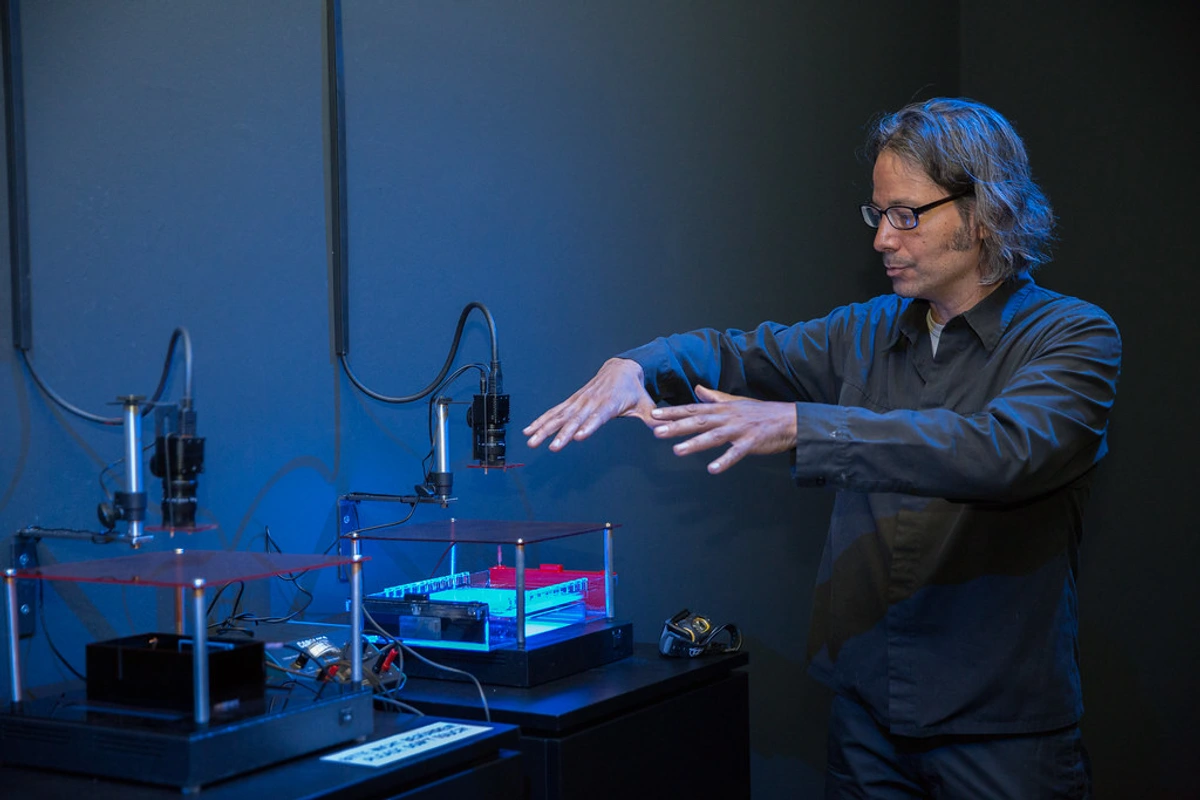

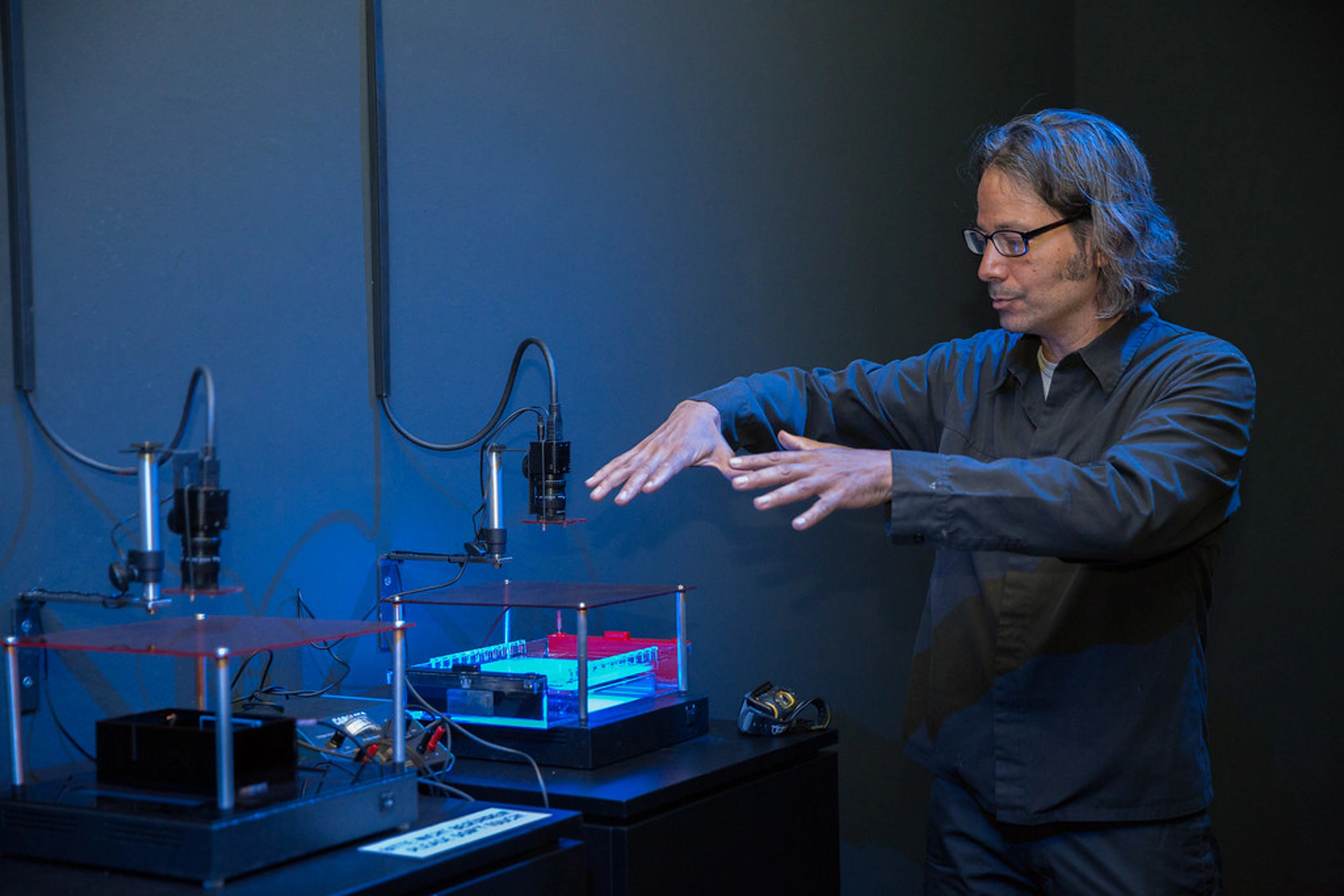

Galleries are, fundamentally, vibrant community hubs. Hosting engaging artist talks, hands-on workshops, thought-provoking panel discussions, film screenings, or even exclusive previews for patrons can generate direct revenue through ticket sales and membership fees. Crucially, these events foster a deeper, more meaningful engagement with their audience. I love seeing a good 'Q&A with a Gallerist' session, as it always demystifies aspects of the art world that I, and I suspect you, might not fully grasp. These programs not only generate direct revenue but also build invaluable loyalty, create a tangible sense of community, and attract new visitors who might become future clients. They can also lead to valuable partnerships with educational institutions or other cultural organizations. Speaking of which, our article on qa-with-a-gallerist-on-discovering-new-talent offers a more in-depth peek behind that curtain. These programs also serve a crucial role in demystifying the often-intimidating art world, making it more approachable for new audiences and fostering a new generation of art enthusiasts and potential collectors. They are vital for audience development, transforming casual visitors into engaged supporters. I've seen how a well-curated talk can spark a lifelong passion! These initiatives can also lead to valuable partnerships with educational institutions, local community organizations, or even other cultural organizations, amplifying their impact and reach. They are an investment in the gallery's future, nurturing both artistic appreciation and a pipeline of potential patrons. It's truly about cultivating a lasting relationship between art and the public, transforming spectators into participants.

Corporate Art Programs and Strategic Partnerships

Beyond simple transactional sponsorships, some forward-thinking commercial galleries develop comprehensive corporate art programs or forge deep, strategic partnerships with businesses across various sectors. This can involve curating permanent art collections for corporate headquarters, managing dynamic rotating exhibitions in office spaces or luxury retail environments, or developing bespoke art experiences for a company's high-value clients or employees. These deeper collaborations provide significant and stable income, open up new networks of high-net-worth individuals, and provide valuable exposure for the gallery's artists in non-traditional settings. It's about finding truly creative synergies between the art world and the business world, creating a mutually beneficial ecosystem where art enhances corporate environments and corporate support underpins artistic endeavors. These programs can range from curating permanent collections to managing dynamic rotating exhibitions or even facilitating artist-in-residence programs within a company. Imagine an artist working in a tech firm's lobby, drawing inspiration from the daily hustle – that's the kind of innovative synergy I'm talking about. It's a proactive approach to funding that not only provides stable income but also elevates the gallery’s public profile and integrates art into diverse sectors of society, demonstrating its tangible value beyond pure aesthetics. These partnerships are a testament to the growing recognition that art isn't just a luxury, but a powerful asset for branding, employee well-being, and client engagement. I've even seen galleries facilitate artist-in-residence programs within corporations, creating truly immersive and unique cultural experiences.

The Role of Patrons, Donations, and Grants (Especially for Non-Profits)

Now, not all galleries operate under a purely commercial, profit-driven model. Indeed, a significant, and arguably indispensable, portion of the art world operates under a vastly different financial paradigm, encompassing non-profit galleries, university galleries, and public institutions. While commercial galleries can occasionally receive project-based donations, grants, or corporate sponsorships (especially for educational or community outreach initiatives), these sources are typically the absolute lifeblood of their non-profit counterparts. These institutions often embody a deeply communal, public-facing spirit, relying heavily on broad public and private support to fulfill their cultural mandates, prioritize education, and ensure wide accessibility to art. Unlike commercial galleries, their driving force is a public mission, not profit, which fundamentally shapes their funding strategies. They are the keepers of our cultural memory, often preserving works that might not have a immediate commercial market but hold immense historical or social value.

Individual and Group Memberships: Cultivating Community

For non-profit and public galleries, memberships are a vital, consistent, and recurring revenue stream, and a profoundly powerful way to build a loyal, engaged community. Individuals, families, and even corporate groups pay an annual fee to receive a range of benefits such as free admission, exclusive previews to new exhibitions, discounts on merchandise or events, and coveted invitations to members-only gatherings. This model fosters a deep sense of ownership and belonging, transforming passive visitors into active supporters who feel personally invested in the gallery's mission and long-term longevity. It's a testament to how people genuinely want to be part of something meaningful, and the tiered benefits (ranging from basic access to exclusive director-led tours or private collection visits) cater to varying levels of engagement and generosity. This model not only provides critical, predictable income but also transforms the audience into a community, a network of passionate advocates who actively support the gallery’s long-term vision. It's a win-win, fostering both financial stability and cultural impact. I've always been struck by the passion of gallery members, their commitment often going far beyond the monetary contribution.

Private Philanthropy and Major Donors

Wealthy individuals, families, and private foundations often play a particularly crucial role in supporting non-profit art institutions. These major donors might fund specific, ambitious exhibitions, vital educational programs, artist residencies, or contribute significantly to endowments that ensure the gallery's long-term sustainability and operational health. Their motivations often extend far beyond simple tax benefits; they are typically driven by a deep, abiding passion for the arts, a profound desire to preserve cultural heritage for future generations, or an unwavering commitment to community engagement and social impact. Cultivating these deeply personal relationships involves incredibly careful stewardship, transparently demonstrating the tangible impact of their contributions, and meticulously aligning donor interests with the gallery's overarching mission. It's a delicate dance of passion and purpose, requiring both strategic vision and genuine connection. I genuinely believe it's a beautiful cycle when done right—those who are fortunate enough to have resources, support those who create, preserve, and display, ensuring the cultural commons remains rich and vibrant for all. These patrons often view their contributions as an investment in society’s cultural well-being, rather than a mere donation. This form of support is often foundational, allowing institutions to plan for the long term and take on ambitious projects that commercial entities might shy away from. It's a testament to the enduring human impulse to contribute to something larger than oneself, to leave a lasting mark on culture.

Government Funding & Arts Councils

In many countries, government bodies and national or regional arts councils (like the National Endowment for the Arts in the US, or Arts Council England) provide essential grants and subsidies to galleries and museums. This public funding often comes with explicit mandates to promote cultural accessibility, support local artists, preserve national heritage, or foster specific educational initiatives that serve broad public interests. Applying for these grants is a rigorous, highly competitive process, often requiring detailed proposals outlining artistic merit, measurable community impact, and stringent financial transparency. It's notably less common for purely commercial galleries to successfully tap into this wellspring of funding, as the stringent criteria typically prioritize demonstrable public benefit and non-profit status rather than private profit. However, some forward-thinking commercial galleries with robust community outreach programs, significant educational components, or initiatives supporting underrepresented artists might find specific project-based grants applicable. The key is a compelling narrative that unequivocally highlights public engagement, demonstrating a clear return on public investment. Our article on how-to-write-an-artist-grant-proposal might be useful if you're thinking about grants in a different context, perhaps from the artist's perspective. The key for public funding is demonstrating clear public benefit and alignment with cultural policy objectives. It’s not just about showcasing art; it’s about proving how that art serves the community, educates, or preserves heritage. These grants often require extensive reporting and evaluation, ensuring accountability for public funds. It's a rigorous process, but one that underscores the public trust placed in these institutions.

Corporate Sponsorships

Corporate sponsorships are another significant funding source, particularly for large-scale exhibitions, educational programs, or public events. A company might sponsor a show in for prominent branding opportunities, exclusive client entertainment events, or simply aligning themselves with cultural prestige and community engagement. It's a mutually beneficial relationship: the gallery gets crucial funding and resources, and the corporation gets positive exposure, enhanced public image, and a unique platform for marketing. From luxury brands seeking cultural cachet to local businesses aiming for community goodwill, companies recognize the immense value in connecting with the arts, not just as a marketing tool, but as a statement of their values and a powerful platform for enhanced public relations and brand storytelling. I often find myself pondering just how deeply interwoven art and commerce truly are, in intricate ways we often don't consciously acknowledge or appreciate. These partnerships can be highly creative, extending to joint product launches, co-branded digital content, or even philanthropic matching programs. It’s a sophisticated strategy that moves beyond simple logo placement to deeply integrated collaborations, creating shared value for both the corporate sponsor and the cultural institution. The cultivation of these relationships often involves demonstrating the gallery's reach and the alignment of its mission with the corporation's values, effectively creating a powerful synergy that benefits all parties involved. I've witnessed some incredibly innovative corporate sponsorships that have truly elevated both the art and the brand.

Endowments and Planned Giving: Securing the Future

For non-profit galleries and institutions, endowments are a cornerstone of long-term financial stability, providing a vital buffer against economic uncertainties. An endowment is essentially a carefully managed pool of donated assets (money, stocks, property) that is invested to generate income. The principal amount is typically kept intact, and only a portion of the investment return is used to fund operations, exhibitions, or specific programs annually. This provides a reliable, perpetual revenue stream, shielding the institution from immediate economic fluctuations and enabling robust long-term strategic planning. It's the ultimate act of ensuring institutional legacy and sustained cultural impact.

Planned giving, through instruments like wills, trusts, or bequests, is how many individuals contribute to these endowments, leaving a lasting legacy that extends beyond their lifetime. It's a profound way for individuals to ensure the art and culture they cherish continues to thrive, be preserved, and remain accessible for generations to come. These gifts, often made through wills, trusts, or bequests, are the ultimate expression of long-term commitment to culture and its role in society. This forward-thinking approach ensures that institutions can plan for generations, providing a stable foundation for future exhibitions, educational programs, and acquisitions. I've often thought that planned giving is one of the most selfless forms of cultural patronage, ensuring that art continues to enrich lives long after the donor is gone. It's a profound way to ensure the artistic legacy of a community endures, a gift that keeps on giving for generations to come.

Here’s a quick overview of the main differences in funding:

Funding Source | Commercial Gallery | Non-Profit/Public Gallery |

|---|---|---|

| Primary Income | Art sales (commissions, direct sales) | Grants, donations, memberships, government funding |

| Secondary Income | Consulting, rentals, publications, events | Limited sales, gift shop, event rentals, endowments |

| Motivation | Profit, artist representation, market influence | Cultural preservation, education, public access, mission |

| Funding Risk | Market fluctuations, sales performance | Donor fatigue, grant availability, economic downturns |

The Hidden Costs of Running a Gallery

Operational Expenses: The Cost of Keeping the Doors Open

Understanding revenue streams is one thing, but, as any gallerist will tell you, it’s only half the story. The expenses involved in running an art gallery are staggering, and they eat into every penny earned, often demanding a relentless financial vigilance. I once calculated what it would take to run even a modest space, and my head started spinning at the sheer scale of the overhead. It's unequivocally a passion project, yes, but also a full-blown, high-stakes business with significant, often relentless, overhead. Many aspiring gallerists, myself included, have had their eyes opened by the sheer scale of these expenditures. It's not a business for the faint of heart, or wallet, for that matter, but a true test of passion meeting pragmatism. It's a constant balancing act between idealistic vision and the cold, hard numbers. Let’s tick off a few of these essential, yet often overlooked, costs, shall we?

- Real Estate: Prime gallery locations in art hubs like New York, London, Paris, or Amsterdam come with eye-watering rents or significant mortgage payments. Even a modest space isn't cheap. Beyond the base rent, consider utilities (which can be substantial for climate control to protect valuable artworks), property taxes, ongoing maintenance, and occasional renovations to keep the space fresh, appealing, and compliant with exhibition standards. The choice of location isn't just about prestige or a pretty storefront; it's a critical, often make-or-break, strategic decision that profoundly impacts foot traffic, client access, brand perception, and ultimately, sales potential. For many, being in a globally recognized art center is almost a necessity, and every square meter, in a prime location especially, comes with an astronomical price tag. This initial investment in location is a foundational commitment that shapes a gallery's entire operation. Imagine trying to run a high-end commercial gallery from a converted garage; it just wouldn't carry the same weight or attract the same clientele. The address, the architecture, the foot traffic – it all contributes to the gallery's brand and its ability to attract both artists and collectors. For many, being in a globally recognized art center like art-capitals-of-the-world or Florence, as explored in articles discussing the best galleries in Florence, is almost a necessity, and every square meter, in a prime location especially, comes with an astronomical price tag. The constant pressure to justify these costs through sales is immense, making location perhaps the single most impactful financial decision a gallery can make. I once heard a gallerist quip, 'It's not just about the art, it's about the address!'

- Staffing: Galleries employ a diverse range of highly specialized professionals. Beyond the visionary gallerists themselves, there are dedicated sales associates, registrars who meticulously manage inventory, provenance, and complex logistics (a truly vital role!), marketing and PR specialists, skilled art handlers, administrative support, and sometimes even in-house curators or education coordinators. These are skilled individuals whose expertise is not just crucial, but often irreplaceable, and paying them fairly, along with competitive benefits and ongoing professional development, constitutes a substantial ongoing cost. Many galleries also rely on a crucial network of freelancers and contractors for specific projects—ranging from exhibition installation and lighting design to graphic design and digital content creation—adding to the overall payroll and human resource management complexity. Attracting and retaining top talent in such a specialized field, individuals with deep art historical knowledge, impeccable client relations skills, and logistical prowess, is a constant, significant investment. I've always seen a gallery's staff as its true unsung heroes, the vital backbone of its daily operations. From the sharp-eyed registrar who tracks every artwork’s movement with military precision, to the marketing guru crafting compelling narratives, and the art handlers who can install a monumental sculpture without a scratch – these are highly specialized roles. It's a team effort that relies on a deep bench of expertise, all contributing to the seamless operation and stellar reputation of the gallery. A single knowledgeable and well-connected staff member can be invaluable to a gallery's success, making the investment in their retention paramount. I've seen dedicated teams pull off miracles, transforming empty spaces into breathtaking exhibitions against impossible deadlines and budgets. It’s a quiet ballet of professionalism, ensuring that the magic of art can be presented flawlessly to the public.

- Insurance: You're dealing with incredibly valuable, often irreplaceable, and inherently fragile objects, frequently transported across continents and displayed in public spaces. Therefore, art insurance isn't your average homeowner's policy; it's a highly specialized, exceptionally expensive, and absolutely non-negotiable category. This includes comprehensive coverage for the artwork itself (from the moment it leaves the artist's studio, through every stage of transit, exhibition, and secure storage), general property liability, professional indemnity, and often specific policies for international shipments, high-value loans, or major art fair participation. The cost of this specialized coverage directly correlates with the cumulative value of the inventory, the frequency of transit, the fragility of the mediums, and the inherent risks involved, which, let me tell you from personal observation, are never small and often necessitate intricate planning for every single piece of art. This isn't just about theft or damage; it can include coverage for natural disasters, extreme changes in temperature or humidity, and even political unrest if dealing with international shipments, making it a complex and vital operational expense. Understanding this intricate web of protection is crucial for collectors too, as detailed in our guide on art-storage-solutions-for-collectors and other resources on protecting your valuable collection. It's a non-negotiable safeguard in a business dealing with irreplaceable, high-value assets, often requiring a dedicated team to manage the constant risk assessments and policy adjustments. I've often thought that art insurance is truly a testament to the immense value, both monetary and cultural, that we place on these objects.

- Marketing & PR: Getting eyes on the art, both locally and globally, requires consistent, creative, and often costly effort. This includes traditional advertising in art magazines, elaborate exhibition openings and private views that act as social events, artist dinners to cultivate collector relationships, professional public relations campaigns to secure media coverage, maintaining a cutting-edge website with integrated e-commerce capabilities, robust and analytical social media engagement, and producing high-quality print and digital catalogs. In today's fiercely competitive landscape, a robust, engaging online presence and sophisticated, authentic storytelling are paramount for cutting through the noise. This expertise, whether cultivated in-house or outsourced to specialized agencies, invariably comes with a significant and ongoing price tag. It's not just about spending money; it's about strategic investment in visibility and narrative, ensuring the gallery's unique voice and the artists it represents resonate powerfully in a crowded cultural landscape. Think about the careful crafting of press releases, compelling artist statements, and engaging social media content – it's all part of the essential art of storytelling and brand building. In today’s crowded media landscape, simply having great art isn't enough; you need to tell its story, connect with audiences on multiple platforms, and cultivate a strong brand identity that resonates globally. This expertise, whether cultivated in-house or outsourced to specialized agencies, invariably comes with a significant and ongoing price tag. It's a strategic investment in visibility and narrative, ensuring the gallery's unique voice and the artists it represents resonate powerfully in a crowded cultural landscape. I've often seen galleries leverage compelling visual storytelling, sometimes with articles like visual-storytelling-techniques-in-narrative-art, to create a deeper connection with their audience. It's a blend of art, psychology, and astute communication, a constant dance to capture attention in a noisy world.

- Shipping & Logistics: Moving art, whether across town for a local delivery or across the world for an international art fair, is incredibly complex, time-consuming, and costly. This involves custom-designed, often climate-controlled crating, navigating complex international customs documentation, relying on specialized fine art shippers with climate-controlled vehicles, and employing highly trained art handlers. The cost can fluctuate wildly based on size, weight, destination, urgency, and the specific security requirements of the artwork. And speaking of keeping art safe, if you're a collector, you might be interested in our guide on art-storage-solutions-for-collectors, because proper care extends far beyond the gallery walls. Every tremor, every temperature change, every bump in the road is a potential disaster for irreplaceable artwork, making this a highly specialized, rigorously planned, and costly necessity that demands the utmost precision. This often involves custom-designed, climate-controlled crating, specialized fine art shippers, and meticulous customs documentation for international transit. It’s a logistical ballet where one wrong step can be catastrophic, and I've heard stories that would make your hair stand on end about pieces lost or damaged in transit, or held up indefinitely by bureaucratic nightmares. The expertise required here is truly astounding, demanding a level of precision that most other industries rarely encounter. It's a silent, high-stakes operation that underpins the entire global art market.

- Installation & Framing: Presentation, as they say, is everything—especially when it comes to displaying invaluable art. Professional, museum-quality framing, specialized track lighting meticulously calibrated to enhance each artwork, custom-fabricated pedestals, and the careful, often intricate, installation of artworks are absolutely essential for every exhibition. This requires highly skilled labor, specialized equipment (from laser levels to custom mounting systems), and a meticulously keen eye for aesthetics, all contributing to creating the immersive, professional, and visually compelling environment that truly defines a gallery space and elevates the artwork within it. It's an art in itself, crucial for both the aesthetic presentation and the long-term preservation of the artwork. Imagine how different a piece feels under perfect, balanced lighting compared to a badly lit corner – the impact on perception and appreciation is profound, and worth every investment. This includes not just the initial setup, but also ongoing maintenance to ensure optimal viewing conditions throughout an exhibition's run. It's an art in itself, crucial for both the aesthetic presentation and the long-term preservation of the artwork, ensuring that the artist's vision is presented exactly as intended. I've often thought of the installation process as a silent performance, where every detail contributes to the overall narrative of the exhibition, a carefully choreographed experience for the viewer.

- Conservation & Restoration: Over time, and even with the most meticulous care, art may inevitably need expert conservation and restoration to maintain its condition and integrity. This isn't cheap, as it requires highly specialized, often renowned, conservators who possess a rare blend of scientific knowledge, artistic sensibility, and meticulous technique. This can range from preventative measures like maintaining precise environmental control within the gallery (temperature, humidity, light levels) to remedial restoration for damage sustained during transit, display, or even from its natural aging process. These costs are often unpredictable, emerging unexpectedly, but are absolutely critical for preserving both the aesthetic integrity and the long-term market value of the artwork. A damaged or poorly restored piece can lose significant value, making this an essential, albeit sometimes painful, investment that protects both the artwork's historical integrity and its market potential for future generations. It’s a testament to the gallery’s commitment to the longevity of the art itself, a silent guardian ensuring that artistic legacies endure. I've seen meticulous conservation efforts breathe new life into ancient works, proving that sometimes, the greatest artistic heroism lies in preservation.

- Legal & Administrative Fees: Running any business, let alone one navigating the complexities of the international art market, means dealing with a constant, often overwhelming, stream of legal and administrative requirements. This includes meticulously drafted contracts (with artists, collectors, shippers, insurers), navigating intricate intellectual property rights, adhering to international art law, and ensuring general corporate and tax compliance. Expert legal advice isn't free, nor should it be, given the high stakes involved. Neither are professional accounting services, banking fees, specialized database software subscriptions for comprehensive inventory and client management, secure website hosting, robust cybersecurity measures, office supplies, and all the myriad small but crucial things that keep a professional business running smoothly. It's decidedly not glamorous work, but it's utterly essential for maintaining legitimacy, protecting invaluable assets, and ensuring the smooth, compliant operation of the business. Cutting corners here is a recipe for disaster in the art world, where provenance, authenticity, and legal standing are paramount, and navigating international art law is a specialized field in itself. From meticulously drafted contracts with artists and collectors to understanding complex intellectual property rights and adhering to global tax compliance, legal diligence is a constant, expensive, but utterly indispensable requirement. Professional accounting services, specialized database software, and robust cybersecurity measures are also non-negotiable necessities for maintaining legitimacy and protecting invaluable assets. I've often heard that a gallery is only as strong as its legal framework, and I couldn't agree more. It's the unglamorous but absolutely essential bedrock upon which the entire dazzling edifice of the art world rests.

- Technology and Digital Infrastructure: In the 21st century, a gallery's digital footprint is almost as important, if not in some cases more important, than its physical one. This translates into significant, ongoing costs for developing and maintaining a cutting-edge website, often with integrated e-commerce capabilities, immersive virtual viewing rooms, and robust digital archiving systems for high-resolution images and metadata. Beyond the website, there's investment in specialized art management software, sophisticated customer relationship management (CRM) systems to track client interests and interactions, and advanced cybersecurity measures to protect sensitive client and invaluable inventory data. These technological investments are no longer optional; they are fundamental operational necessities, bridging the gap between physical and digital engagement and offering new, essential avenues for client interaction and sales, especially in a globalized market. I've seen firsthand how a beautifully designed virtual exhibition can reach audiences worldwide, breaking down geographical barriers and opening up new markets.

Challenges, Adaptations, and the Future of Gallery Funding

Evolving Challenges: Navigating a Dynamic Art Market

The funding landscape for art galleries is by no means static; it's a dynamic, ever-evolving terrain, constantly reshaped by global economics, rapid technological advancements, and shifting cultural priorities. Galleries, especially commercial ones, are in a perpetual state of adaptation, innovating continuously to remain viable, relevant, and competitive in a fast-paced world. This isn’t a leisurely stroll; it’s a constant, exhilarating, and sometimes terrifying sprint to stay ahead of the curve. The external forces shaping the art market are relentless, demanding both foresight and flexibility.

Navigating Economic Shifts and Market Volatility