Navigating Art Market Bubbles: A Curator's Personal Guide to Enduring Value

Unravel the art market's unpredictable whims with a curator's candid insights. Learn to spot speculative bubbles, identify genuine artistic value, and build a resilient collection that transcends fleeting trends and hype.

Navigating the Art Market's Whims: My Curator's Guide to Enduring Value Beyond Bubbles

The art market... ah, what a beast it can be. I've spent years immersed in its currents, as a creator and a lifelong admirer, and let me tell you, it's not always the serene, contemplative space one might imagine. Sometimes, it feels less like a quiet gallery opening and more like a high-stakes poker game, especially when those familiar art market bubbles begin to inflate, or when a new, flashy trend sweeps through, leaving everyone breathless but sometimes devoid of substance. I’ve certainly had my moments where the 'herd mentality' felt like an irresistible current, and that fear of missing out could be a powerful, irrational beast, pushing me to consider things I wouldn't otherwise. It’s a humbling reminder that even with years of experience, a little bit of healthy skepticism is always in order. My journey through this often-bewildering dance has taught me that understanding these market quirks isn't just about financial prudence; it's about protecting the very soul of a collection, ensuring it speaks to something deeper than fleeting trends. So, let's explore how to discern true, enduring artistic value amidst the market's often dizzying peaks and troughs, and learn to navigate those speculative surges without losing our artistic compass, ultimately building a collection that resonates for generations.

What Constitutes an Art Market Bubble?

An art market bubble emerges when the price of art—whether across the entire market, a specific genre, or even the work of a single artist—gets wildly out of sync with what it's truly worth. What do I mean by "truly worth"? Well, that’s where intrinsic value comes in. For me, intrinsic value is a piece's core worth based on its artistic quality, innovation, conceptual depth, unique contribution to art history, rarity, and provenance. It's the enduring significance that transcends fleeting trends, encompassing elements like masterful craftsmanship, profound emotional resonance, and the artist's unique voice and perspective. It also deeply considers the artist's consistent evolution throughout their career and the overall strength and coherence of their body of work, which often signals a deeper, sustained commitment to their craft. Think of a timeless masterpiece with proven historical impact, like a Rothko – its value is deeply rooted in its profound artistic merit, its innovation in Abstract Expressionism, and its consistent critical and institutional acclaim. Now, imagine a digital artwork by a relatively new artist, visually striking but lacking a robust exhibition history or critical dialogue, suddenly selling for millions just because a tech mogul bought one, with prices floating away from reality, driven purely by speculation and collective enthusiasm. That’s when my internal alarm bells start to jingle. I've often watched, sometimes with a wry smile and a slight shake of the head, as prices seem to detach from this reality.

It's a quiet hum that can quickly become a roar, fueled by collective excitement and, let's be honest, a healthy dose of the fear of missing out (FOMO). I've certainly felt that tug myself, that irrational pull towards something simply because everyone else seems to be running there. It's easy to get swept up. Beyond FOMO and herd mentality, this detachment is often amplified by the allure of exclusivity, the desire for social status associated with art ownership, and the sometimes uncritical influence of "art world influencers" who may prioritize buzz over genuine merit, inadvertently pushing prices further from their intrinsic worth. These hype cycles can accelerate exponentially with the speed of social media and online art platforms, amplifying trends and creating instant 'stars' whose market value may lack foundational depth.

Typically, bubbles follow a discernible pattern: an initial phase of discovery, followed by rapid price acceleration, widespread public enthusiasm often amplified by media attention, a market peak, and then an often swift decline or 'burst' as speculative interest wanes and confidence erodes. Grasping these phases is the foundational step towards prudent collecting. But these abstract concepts of detachment and speculation aren't new; history offers us a rich tapestry of examples...

Historical Echoes and Market Dynamics: LessOns from the Past

History, for me, is a comforting teacher, full of cautionary tales and surprising resurrections. The abstract concept of a market bubble becomes alarmingly tangible when we look back, and in the art market, these echoes ring particularly loud. We all know the infamous 17th-century Tulip Mania – a truly wild ride for a flower bulb! But in art? I’ve seen parallels in smaller, perhaps less dramatic, surges throughout history. I often recall the intense market interest around certain Symbolist artists in the late 19th century, or even the initial speculative fever surrounding the Nabis group before their influence truly settled into the art historical canon, with their prices sometimes fluctuating wildly before their ultimate recognition. The lesson here is often about the market's initial struggle to contextualize truly innovative work, leading to volatile pricing before sustained critical and scholarly attention provides anchors. It makes me wonder, how many brilliant minds are we overlooking today, only for their genius to be recognized generations from now?

And yes, even the Impressionist market, which we now revere as a cornerstone of modern art, wasn’t immune; it endured periods of intense speculation and dismissal (often from traditionalists who deemed their work 'unfinished' or 'blurry') before its ultimate, enduring recognition. Their journey taught us that resistance to new aesthetics can initially suppress true value, only for it to surge once societal and critical perspectives catch up. Think too of the early 20th-century avant-garde, like the Futurists or Russian Constructivists. While now canonical, their works sometimes saw rapid price inflation early on, followed by periods of more measured appreciation as their true art historical significance was debated and eventually cemented, anchoring their place in art history. Their story underscores how groundbreaking innovation, though initially met with speculative excitement, requires careful historical and critical integration to achieve lasting value. It’s a good reminder not to dismiss something simply because it’s new, but also not to blindly embrace it.

Even in more recent times, some segments of the 1980s art boom saw significant price surges and subsequent corrections, while the initial frenzy around certain Abstract Expressionists eventually settled into a more nuanced appreciation. And who could forget the meteoric rise and subsequent correction in parts of the NFT market? It certainly felt like a modern-day echo of earlier speculative waves, demonstrating how even new technologies can't escape old market patterns. It makes you wonder, doesn't it, what we're truly valuing in the moment? I've certainly watched economic booms amplify the art market's exuberance, and downturns bring a swift, often painful, dose of reality, revealing just how ephemeral purely speculative value can be. These economic cycles often act as accelerators, turning a gentle market breeze into a full-blown speculative gale, or vice versa.

The key distinction, as I’ve observed over the years, often lies in the sustainability of demand. Is it driven by genuine cultural appreciation and a growing, informed collector base, or by rapid flipping, investment-driven speculation, and a fleeting public fascination? Moreover, the role of institutions like art foundations and artist estates often proves crucial in anchoring long-term value. They achieve this by carefully managing an artist's legacy, ensuring scholarly engagement, organizing controlled exhibitions, and facilitating publications, thereby reinforcing an artist's significance and stabilizing markets beyond transient market blips. To gain a deeper understanding of these market movements, I'd encourage you to consult resources on understanding art market trends: a guide for emerging collectors and the art market trends and future outlook – they can offer a broader view than a single, impassioned artist's perspective. So, what's ringing your alarm bells these days?

![]()

Identifying the Warning Signs of a Bubble: My Internal Alarm Bells

Ever get that nagging feeling that something in the art market is just a little too good to be true? If you're anything like me, you've developed a sixth sense for these things. That little itch in the back of your mind when everyone seems to be rushing towards the same new sensation, like a flock of very enthusiastic, but perhaps slightly misguided, pigeons. Recognizing these subtle, and sometimes not-so-subtle, indicators of a speculative bubble is paramount for safeguarding your collection and financial well-being. These dynamics are often fueled by psychological biases like 'herd mentality,' where individuals follow the crowd, and the potent 'fear of missing out' (FOMO), pushing impulsive decisions. With the advent of social media and online art platforms, these hype cycles can accelerate exponentially, amplifying trends and creating instant 'stars' whose market value may lack foundational depth. Here’s what my internal alarm bells often ring for:

- Rapid and Unjustified Price Escalation: Prices for works by certain artists or within specific categories rise dramatically over a short period, often without a commensurate increase in critical acclaim, institutional acquisition, or scholarly re-evaluation. I’ve seen pieces, seemingly overnight, go from a few hundred euros to tens of thousands, leaving me scratching my head and wondering if I've missed a memo, or if the market has simply lost its way. It's a strange kind of inflation, where the value seems to defy gravity.

- High Speculative Trading (Flipping): Artworks are bought and sold quickly, often within months, with the primary intention of making a fast profit rather than long-term stewardship or aesthetic enjoyment. For me, that’s a glaring red flag; art isn't just a commodity to be flipped, it deserves a more considered journey. I often think of these pieces as having a 'for sale' sign practically tattooed on them, waiting for the next quick transaction.

- Widespread Media Hype and Public Enthusiasm: The market receives disproportionate attention from mainstream media, often focusing solely on record-breaking auction results or the "investment" potential rather than the art's intrinsic merits. It’s when art headlines start appearing in the financial news section, not the culture pages, that I start to pay closer attention, often with a slight cringe. The narrative shifts from artistic dialogue to financial speculation.

- Influx of New, Uninformed Buyers: Many new participants enter the market, drawn by narratives of quick wealth, often lacking deep knowledge of art history, provenance, or market fundamentals. They’re often chasing the 'next big thing,' without truly understanding why, sometimes simply because everyone else seems to be doing it – a classic case of herd mentality. I've seen it time and again, a rush towards something shiny without much thought for its substance.

- Lack of Critical Scrutiny: Critical assessment and scholarly analysis may be overshadowed by market performance metrics, with commentators focusing primarily on auction results and price points. This is a critical warning sign because true artistic merit, innovation, and historical importance are rigorously debated and established through critical discourse, not just transaction records. When critical dialogue takes a backseat to price tags, the market risks valuing spectacle over substance. It's like judging a book solely by its cover price.

- Lack of Artist Development or Evolution: Especially for emerging artists, a rapid increase in market value without a corresponding development in their artistic practice – conceptually, technically, or thematically – can be a red flag. If an artist's output seems to stagnate or become formulaic, simply replicating earlier successful works to meet market demand, it might indicate market-driven production rather than genuine, sustained artistic growth and innovation. For instance, an artist creating multiple variations of a single, popular motif to satisfy demand, rather than exploring new themes or pushing their technical boundaries, would be a clear signal. True value often stems from an artist's continuous evolution and exploration.

- Questionable or Absent Provenance: For established artists, a lack of documented ownership history is a major red flag. For emerging artists, while provenance might be shorter (often established through gallery records, artist's statements, and consistent exhibition history), a sudden price surge for pieces with no clear exhibition record or limited sales history should give pause. It’s like trying to buy a house without knowing who owned it last – a bit unsettling, isn't it? Trust me, the paper trail matters, even if it's just a digital one from a reputable gallery.

I’ve certainly had my moments where the 'herd mentality' felt like an irresistible current, and that fear of missing out could be a powerful, irrational beast, pushing me to consider things I wouldn't otherwise. A reasoned, informed approach over emotional reactivity is what I always advocate, though it's easier said than done, especially when the market seems to be screaming at you to jump aboard. Trusting your gut (and your research) is key. How do you silence the noise?

To make these distinctions clearer, consider this simplified comparison:

Bubble Indicators | Signs of Enduring Value |

|---|---|

| Rapid, unjustified price hikes | Gradual appreciation based on critical acclaim |

| Focus on quick profit (flipping) | Long-term stewardship and aesthetic enjoyment |

| Media hype on price, not art | Scholarly analysis and cultural significance |

| Influx of uninformed buyers | Informed, growing collector base |

| Market performance over critical dialogue | Robust critical discourse and institutional recognition |

| Lack of artistic evolution | Consistent artistic development and innovation |

| Poor or absent provenance | Documented ownership history (established or emerging) |

Strategies for Navigating a Bubble-Prone Market: My Personal Compass

So, how do we navigate these choppy waters without losing our artistic compass? It's a question I've wrestled with for years, both in my own collecting and in advising others. I recall one particularly bewildering auction where the bidding for a rather unremarkable piece escalated at a rate that defied all logic – it felt like watching a snowball roll downhill, picking up irrational speed with every turn. That evening, I chuckled to myself, relieved I hadn't been swept up in the frenzy, but also reminded of how easily one could be. I nearly bought into a 'hot' new digital artist once, only to find my gut screaming at me after a quick look at their minimal exhibition history and limited critical engagement. A lucky escape, if you ask me, all thanks to a bit of healthy skepticism and extra digging! Here's what I've learned, often through trial and error, sometimes with a gentle nudge from my own past mistakes:

- Do Your Due Diligence: Thoroughly research the artist, their oeuvre, provenance, and critical reception. Understand the historical context and artistic significance of a piece beyond its current market price. This includes delving into the artist's consistent exhibition history at reputable galleries and museums, critical reviews from established art journals and academic publications (looking for consistent themes, analytical depth of technique, and historical contextualization, not just descriptive praise), and documented sales records over a sustained period, not just recent auction highs. Provenance provides a documented history of ownership, assuring authenticity and often enhancing a work's value. For more on this, you might explore understanding art provenance. For emerging artists, while a deep, multi-generational provenance may not exist, a clear and consistent record of gallery representation, artist statements, and a developing exhibition history with reputable spaces are crucial for establishing this early paper trail. Critical acclaim, meanwhile, indicates scholarly recognition and enduring artistic importance. For me, this detective work is often the most rewarding part – unearthing the true story behind a piece. It really taught me that a bit of healthy skepticism and extra digging is always a good investment.

- Focus on Intrinsic Value: Ah, the elusive 'intrinsic value.' For me, this is the anchor, the North Star. It’s about artistic quality that makes your heart skip a beat, the rarity that tells a unique story, the condition that speaks of care and preservation (and here, the diligent work of art conservators is paramount in maintaining a piece's original integrity and longevity), and the historical importance that places a work within the grand tapestry of human creativity. Beyond these, I consider a piece's innovation – how it pushes boundaries or redefines artistic dialogue – and its conceptual depth, meaning the richness of ideas and meaning it conveys, along with the artist's intent and their unique conceptual framework. These are the foundations of long-term value, the things that remain even when market sentiment plays its fickle games. I often ask myself: does this piece move me? Does it challenge my perceptions? Does it whisper secrets about humanity or creativity? That, more than any auction price, is its true, immeasurable worth. It's the joy it brings you, purely and simply. When I think of intrinsic value, I'm thinking about a work by, say, a critically acclaimed artist like Agnes Martin, whose minimalist canvases speak volumes and have decades of museum presence, impeccable originality, and condition. Or perhaps a piece by a contemporary master like Gerhard Richter, whose abstract works, while visually dynamic, are underpinned by profound conceptual rigor and a consistent, evolving artistic practice that has earned sustained critical and institutional acclaim, deeply informed by a clear artist's intent and philosophical framework. This stands in stark contrast to a visually striking but conceptually shallow work by a newly hyped artist whose market trajectory is based purely on trend. The market might temporarily inflate the latter, but the former will likely endure long after the hype has faded, continuing to resonate across generations, shaping artistic discourse for decades to come.

- Diversify Your Collection: Avoid concentrating too heavily on a single artist, movement, or market segment that shows signs of speculative overheating. A diversified collection is inherently more resilient to market corrections. It’s like not putting all your eggs in one basket, a simple truth that applies just as much to art as it does to finance. Or, as I like to think, don't bet the farm on a single lottery ticket!

- Embrace a Long-Term Perspective: Art collecting is often a marathon, not a sprint. Significant appreciation usually occurs over decades, not months. I advise acquiring works one genuinely loves and intends to keep, allowing time for their cultural and market value to mature. Patience, I’ve found, is a rare and precious virtue in this market – and one I occasionally have to remind myself of.

- Seek Expert Advice: Consult with reputable art advisors, gallerists, and scholars who can provide unbiased, seasoned insights and help you make informed decisions, filtering out market noise. I've certainly reached out to advisors myself, especially when delving into a new movement or period. It’s like having a trusted guide in a dense forest, helping you discern the ancient oaks from the fleeting saplings. For deeper insights, consider resources like Q&A with an Art Advisor: Navigating the Contemporary Art Market for New Collectors.

- Be Skeptical of "Get Rich Quick" Narratives: If I had a euro for every time someone promised "guaranteed returns" in art, I wouldn't need to paint! Seriously, if an investment seems too good to be true, it probably is. I caution against being swayed by sensational headlines or promises of guaranteed returns; sustainable value in art is built on intrinsic merit, not speculation. Art is not a stock, and certainly not a magic beanstalk to instant riches.

Ultimately, cultivating an art collection is a deeply personal journey. I encourage you to use these strategies as your personal compass, guiding you towards art that truly resonates, fostering a collection that grows not just in monetary value, but in emotional and cultural richness. What kind of legacy do you want your collection to tell?

The Contemporary and Emerging Art Market: A Closer Look at Tomorrow's Classics

But what about the cutting edge – the contemporary and emerging art market? Now that's a fascinating, bewildering, and often exhilarating place where these dynamics play out with particular intensity. It’s where the future of art is being shaped, but also where bubbles seem to form with a singular effervescence. This is where the strategies we just discussed are most critically applied due to the market's inherent volatility and fewer long-term data points. How do we discern the lasting gems from the transient glitters in this vibrant, often chaotic space? Well, it's often a wild west: artists often have a limited track record, fewer long-term data points exist for objective valuation, and the influence of a small number of powerful galleries, collectors, auction houses, and even art advisors and consultants can amplify trends quickly, sometimes inadvertently adding to the hype cycle. Social media, of course, plays its own role in this rapid amplification. I often find myself both thrilled by the innovation and slightly bewildered by the breakneck speed of it all.

Art fairs and galleries, while vital platforms for exposure and sales, also walk a fine line here. Their strategic marketing, exclusive representation, and curated narratives can both elevate deserving artists and, dare I say, sometimes inadvertently inflate fleeting trends, especially through high-profile presentations and early-career 'discoveries.' This can create a self-fulfilling prophecy of value, making it harder for new collectors to spot what's truly enduring. I've personally seen a promising artist's work skyrocket after a major art fair debut, only for interest to wane quickly when the underlying critical depth wasn't there. When considering emerging artists, establishing provenance typically involves documented gallery sales, a consistent and developing exhibition history, artist statements, and authenticated certificates of authenticity – a different, yet equally crucial, paper trail than for established masters. Beyond these records, look for artists who demonstrate a unique voice, consistent artistic development, and genuine engagement with critical discourse rather than just market metrics.

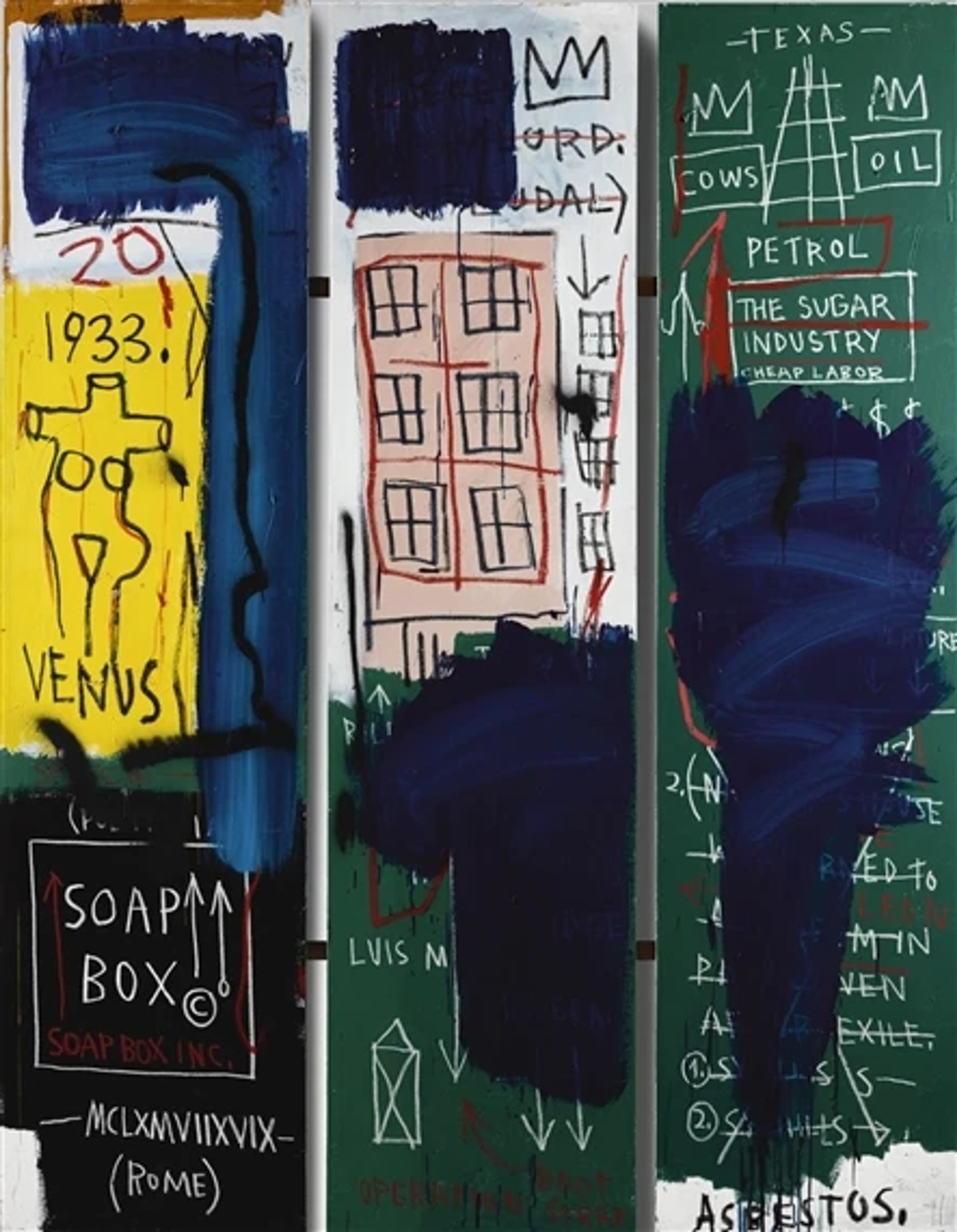

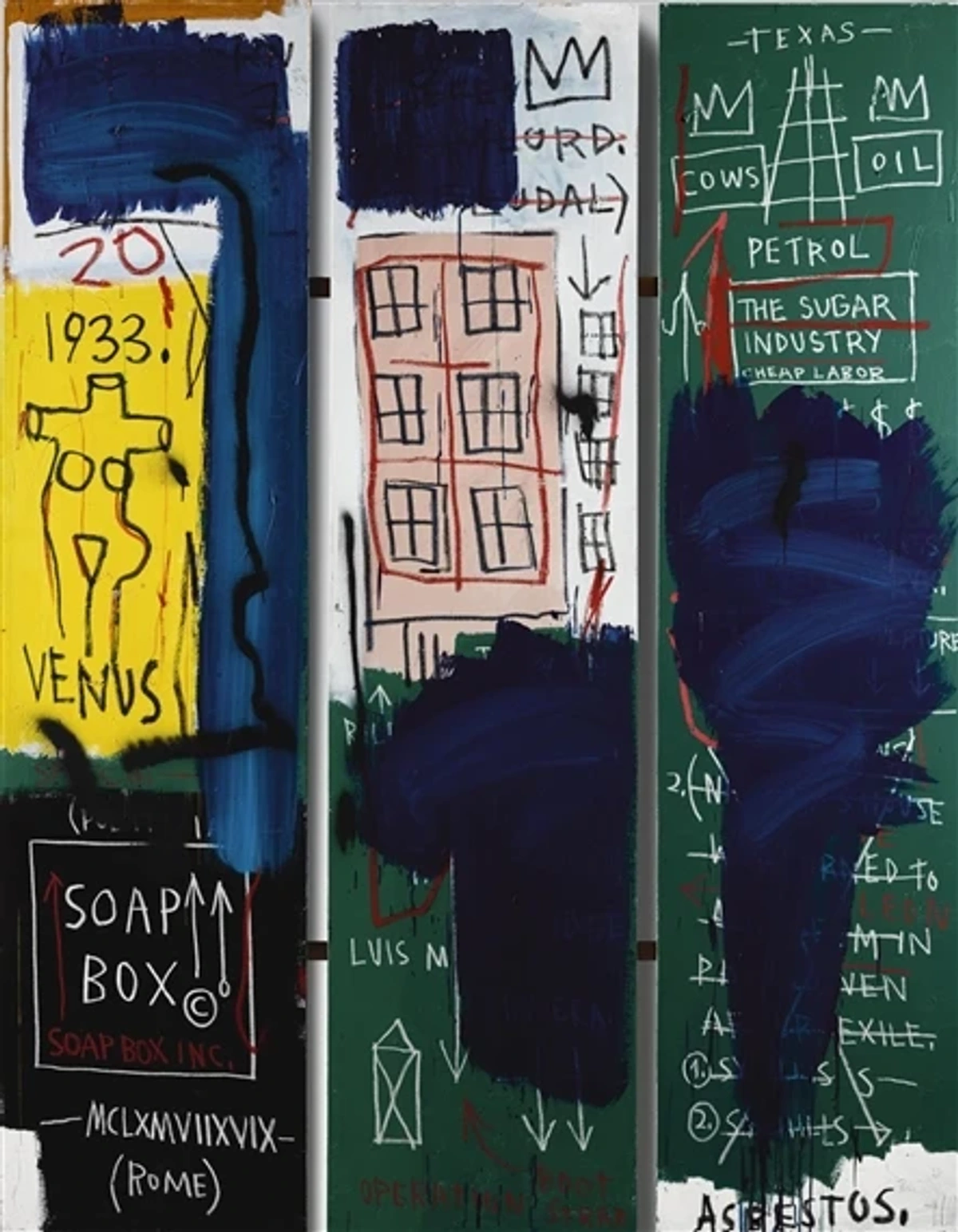

I've also observed how the "artist brand" can sometimes eclipse genuine artistic merit. With social media and influencer culture, an artist’s persona can, for a time, become more prominent than their actual body of work, driving market activity based on celebrity rather than substance. This platform, while fantastic for direct artist-audience connection, can also, perhaps inadvertently, fuel superficial hype. It's a strange dance, one where perception often trumps reality, and one I often observe with a mix of fascination and a little bit of concern for what truly constitutes artistic value. I mean, who hasn't seen a piece rocket in value after a single Instagram post? It’s a dynamic I wrestle with in my own practice, trying to ensure my work speaks for itself beyond any online persona. Think of a figure like Jean-Michel Basquiat; while his historical significance is now undeniable, the early market dynamics around his work certainly exhibited characteristics of rapid, sometimes speculative, appreciation. It’s a delicate balance, trying to discern enduring talent from momentary hype.

This volatile segment is also where digital art and NFTs have recently come into play, exhibiting many classic bubble characteristics: explosive price growth, intense media speculation, and an influx of new buyers driven by FOMO. While offering exciting new mediums and possibilities, the challenge remains to distinguish true artistic innovation and enduring conceptual value from purely speculative digital assets. It's a fascinating, if sometimes bewildering, new frontier that I'm still trying to wrap my head around! The ephemeral nature of some digital assets makes careful evaluation even more critical.

credit, licence

New collectors venturing into these spaces are strongly advised to prioritize artists with consistent critical recognition, robust gallery representation, and a developing, substantial body of work, rather than solely impressive auction results. I've found that exploring abstract art movements or decoding abstract art: a guide to finding meaning in non-representational works can provide a solid foundation for understanding intrinsic artistic value beyond market hype. For further market insights, the annual abstract art market report: key trends and investment opportunities offers valuable context.

On a more philosophical note, participating in or even profiting from speculative bubbles raises ethical questions. While the market is a beast with its own rules, I personally believe in cultivating a collection rooted in genuine appreciation and long-term cultural contribution. Chasing quick profits in art often feels like a disservice to the art itself, turning it into a mere commodity rather than a profound expression of human creativity. It's something I think about deeply in my own artistic practice, striving for work that stands on its own merit, regardless of market fads.

My own artistic journey, detailed on my artist's timeline, has certainly reinforced this enduring commitment to artistic creation that transcends fleeting market whims. If you're looking to cultivate a collection anchored in intrinsic value, perhaps pieces that spark genuine curiosity and connection, you might explore a selection of art that resonates with my own creative principles. And if you're ever in 's-Hertogenbosch, my museum in 's-Hertogenbosch offers a tangible experience of artistic dedication that, I hope, speaks volumes about lasting passion over temporary market blips.

Conclusion: Cultivating an Enduring Collection – A Legacy of Passion

Art market bubbles are an inherent, cyclical feature of dynamic markets, and probably always will be. For me, understanding their mechanisms transcends mere risk avoidance; it is about cultivating a more profound and informed relationship with art itself. It's about looking beyond the fleeting glitters and finding the true, enduring light. By prioritizing fundamental value, conducting rigorous research, and maintaining a long-term, considered perspective, collectors can navigate these sometimes tumultuous waters. This approach not only safeguards investments but, more importantly, fosters the creation of collections that offer both profound aesthetic pleasure and enduring cultural significance – much like the timeless pieces I find myself returning to, whether in a grand institution or my own museum in 's-Hertogenbosch. It's about building a legacy, a visual diary of curiosity and connection, an enduring testament to the human spirit that transcends any market's temporary blips. This, to me, is the true art of collecting: a journey of discovery and a celebration of lasting passion and intrinsic beauty, far removed from the market's transient whims. My own artistic practice, you see, is built on this very foundation – a belief in creating work that speaks to something timeless, even as the market churns, a quiet echo in the grand, sometimes noisy, conversation of art, promising that the pursuit of genuine meaning will always outlast superficial trends. It’s a legacy I strive to build, one brushstroke at a time.

Frequently Asked Questions (FAQ)

Q: How long do art market bubbles typically last?

A: The duration of an art market bubble can vary significantly. While the overall period of inflated prices can span years, the peak of a bubble, and its subsequent burst, are often remarkably swift. For instance, the infamous Tulip Mania peaked dramatically within a few months, though its speculative build-up lasted longer. Similarly, the 1980s art boom saw rapid escalation and then a sharp correction over a couple of years. The exact duration, however, remains highly variable and difficult to predict.

Q: Can a bubble occur for a single artist or only for the entire market?

A: Bubbles can occur at various scales. They can affect the entire art market, specific genres (e.g., a particular style of contemporary art), or even the work of a single artist whose prices become detached from established norms.

Q: Is it possible to profit from an art market bubble?

A: While some speculators might profit by selling at the peak, predicting the exact top is notoriously difficult and risky. It's a gamble I wouldn't advise for most collectors focused on intrinsic value and sustained appreciation; it feels a bit like trying to catch a falling knife.

Q: What happens to art prices after a bubble bursts?

A: After a bubble bursts, prices typically experience a sharp decline, often returning to levels more aligned with fundamental value. It can take years, or even decades, for prices to recover, if they do at all. Some artists or movements might eventually regain recognition and stable value, while others fade into obscurity. It's a stark reminder of the market's volatility and the importance of intrinsic merit.

Q: How can I assess the "intrinsic value" of an artwork?

A: Intrinsic value, while subjective, is assessed through factors such as the artist's historical significance, consistent critical acclaim, quality of execution, rarity, robust provenance, excellent condition (which also highlights the importance of professional art conservators), and its contribution to art history or its innovative qualities. For me, it also encompasses the artist's intent and a work's longevity of impact – does it continue to inspire dialogue, influence subsequent artists, or provoke thought across generations? This is where a deep personal connection and the profound joy a piece brings also form an invaluable, albeit unquantifiable, part of its enduring worth, transcending mere market metrics. I'd suggest starting with thorough research into the artist's consistent exhibition history, critical reviews from reputable sources, and documented sales records over a long period, not just recent auction highs. Ultimately, it aligns with my own philosophy of creating art that resonates deeply and withstands the test of time, demonstrating consistent artistic development and a significant contribution to art history.

Q: What's the difference between collecting art for investment versus personal enjoyment?

A: This is a crucial distinction. Collecting for investment primarily focuses on potential financial returns, often prioritizing market trends, artist's track record, and resale value. While there's nothing inherently wrong with this, it can lead to chasing fleeting trends. Collecting for personal enjoyment, on the other hand, centers on aesthetic pleasure, emotional connection, and intellectual engagement with the artwork. While financial value may grow, it's a secondary consideration. My advice? Prioritize genuine passion; the most fulfilling collections are those built on personal resonance, regardless of market fluctuations.

Q: What about the role of conservation and preservation?

A: Conservation and proper preservation are crucial for maintaining an artwork's intrinsic value over time. A well-maintained piece retains its original integrity, condition, and aesthetic quality, ensuring its longevity and continued appeal to future generations and scholars. The expertise of art conservators is invaluable here, as they safeguard not just the physical object, but its historical and artistic narrative, ensuring the artist's original vision is preserved and accurately represented. Neglect can severely diminish both its aesthetic and market value, fundamentally compromising its intrinsic worth.

Q: What about new technologies like NFTs and digital art – are they prone to bubbles?

A: Absolutely. While exciting and innovative, new digital art forms, particularly NFTs, have shown classic bubble characteristics: rapid price escalations, intense media hype and speculative trading driven by social media and FOMO, and an influx of new, often uninformed buyers. As with traditional art, discerning intrinsic artistic value from speculative fervor remains the key, and often, the biggest challenge. It's a fascinating, if sometimes bewildering, new frontier that I'm still trying to wrap my head around! The ephemeral nature of some digital assets makes careful evaluation even more critical.

Q: What role do artist foundations and estates play in the art market?

A: Artist foundations and estates are crucial for anchoring long-term value and stability in the art market. They manage an artist's legacy by authenticating works, overseeing scholarly research, organizing controlled exhibitions, and facilitating publications. This careful stewardship reinforces an artist's significance, ensures their place in art history, and helps stabilize their market beyond transient blips. They are, in essence, the long-term custodians of an artist's enduring cultural contribution.